| | In today’s edition: The biggest news from the Future Investment Initiative in Riyadh.͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- HUMAIN’s AI playbook

- Invest in America

- What about Saudi?

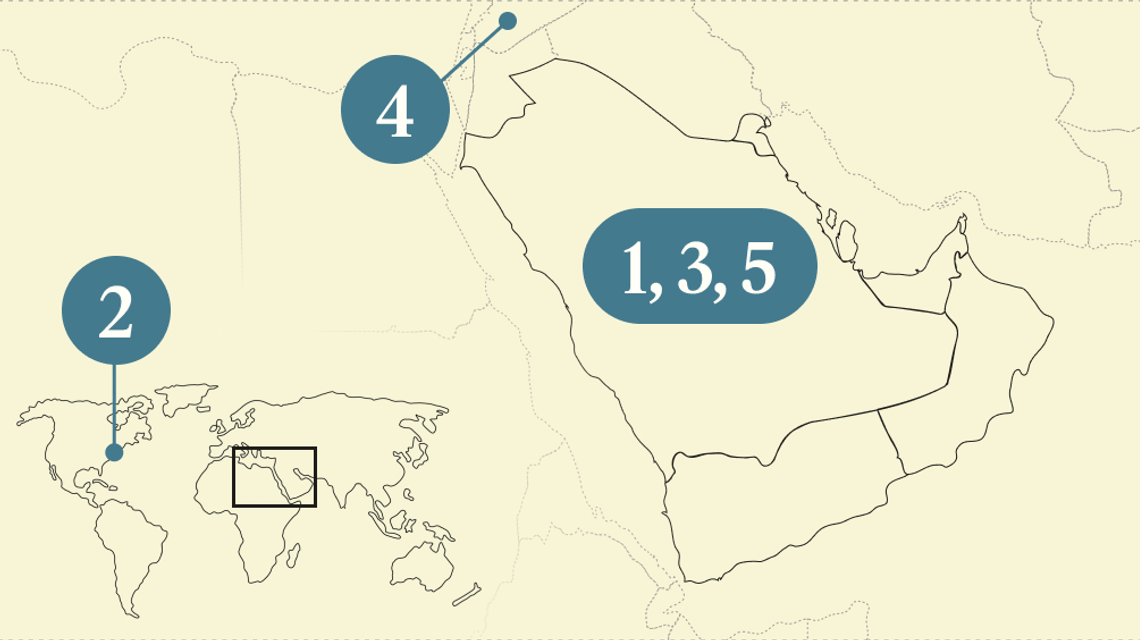

- A lifeline for Syria

- FII’s biggest deals

Saudi launches its first luxury train, ‘Dream of the Desert.’ |

|

Saudi’s AI bid comes to life |

HUMAIN CEO Tareq Amin. Courtesy of FII. HUMAIN CEO Tareq Amin. Courtesy of FII.The scale of Saudi Arabia’s AI ambitions came into sharp focus at the Future Investment Initiative (FII) in Riyadh. Public Investment Fund–backed AI company HUMAIN, which is less than six months old, is striking deals with some of the biggest names in energy, finance, and technology — part of a sweeping plan to position the kingdom as the third-largest AI infrastructure provider after the US and China. Aramco will become a “significant” minority shareholder, and the world’s biggest oil exporter will contribute its “AI assets, capabilities and talent into HUMAIN,” the company said in a statement. HUMAIN also signed a $3 billion agreement with AirTrunk, backed by Blackstone, to build a large-scale data center campus in Saudi Arabia. And California’s Qualcomm Technologies, which plans to manufacture an AI chip to rival market-leader Nvidia, chose HUMAIN as its first customer. — Manal Albarakati |

|

Wall St. pitches itself in the kingdom |

Courtesy of FII Courtesy of FIIWall Street heavyweights opened Saudi Arabia’s premier investment conference — key to the kingdom’s efforts to attract foreign capital — by touting America. The dollar’s slip this year reflects investors’ past overexposure to US assets, but that trend is reversing, BlackRock CEO Larry Fink said at the event. Money is flowing back because there’s still a “deep belief in the opportunity in the US,” which is spending “more than almost anywhere else” on technology. Goldman Sachs CEO David Solomon said there isn’t “compelling evidence of an economic slowdown in the near term” in the US. Meanwhile, the biggest drag on the global economy — the trade war between Washington and Beijing — may soon ease, according to Blackstone CEO Steve Schwarzman. “Both presidents want to lower the temperature significantly,” said Schwarzman, who has been involved in some of the discussions. — Mohammed Sergie |

|

Saudi ready for foreign capital |

PIF Governor Yasir Al-Rumayyan. Courtesy of FII. PIF Governor Yasir Al-Rumayyan. Courtesy of FII.With oil prices below the levels Saudi Arabia forecast when launching its economic transformation almost a decade ago, the kingdom has become a net importer of capital — still building foreign assets but borrowing more to fund domestic projects. This has made Saudi Arabia’s annual investment confab a venue to both deploy cash globally and lure investors to the country, and officials at FII are touting that the latter effort is bearing fruit. Public Investment Fund Governor Yasir Al-Rumayyan said foreign investment rose 24% to $31.7 billion last year, proof that “we have taken Saudi Arabia to the world, and now the world is coming to Saudi Arabia.” There have been fewer gigaproject updates this week, but more clarity on the next phases of Saudi Arabia’s government-led economic transformation plans. Private capital is expected to take a bigger role now that laws and regulations are revamped, and new infrastructure is being delivered. “It’s time for us to maybe scale back on this government or PIF spend to prove and to seed some of these value chains and clusters, and let the private sector come in and start investing,” said Khalid Al-Falih, minister of investment. — Mohammed Sergie |

|

FII rolls out red carpet for Syria |

The Syrian Parliament in Damascus. Khalil Ashawi/Reuters. The Syrian Parliament in Damascus. Khalil Ashawi/Reuters.The geopolitics of the region doesn’t factor at FII, which focuses more on economic development and finance. But one attendee (set to speak shortly after this briefing hits your inbox) is Syrian President Ahmed Al-Sharaa. Saudi Arabian companies have been active in Syria, signing deals worth more than $6 billion over the summer. Most are still under discussion, and both governments are trying to accelerate implementation now that most sanctions on Syria have been lifted — as promised by US President Donald Trump on his own visit to The Ritz-Carlton Riyadh in May. Around $2 billion in projects will now proceed, Saudi’s investment minister told Al Arabiya. Many countries are vying for a role in stabilizing Syria. Unlike Israel and Türkiye, which have security interests and the military capabilities to directly intervene, Saudi Arabia and other Gulf countries are focusing on shaping Syria’s economy, using investment to exert influence in the war-torn country. — Mohammed Sergie |

|

AI deals (unsurprisingly) dominate |

Mohammed Benmansour/Reuters Mohammed Benmansour/ReutersThe deal volume at FII, so far, isn’t on track to surpass previous years. But artificial intelligence and infrastructure are clearly in the lead. HUMAIN signed a $3 billion data center agreement with AirTrunk, backed by Blackstone, and a non-binding agreement for Aramco to take a minority stake in the firm. Continuing the AI flurry, Google committed up to $100 million for AI in real estate. On the energy front, Aramco closed an $11 billion leaseback deal on gas assets with a consortium of investors led by BlackRock, and ACWA Power secured $6 billion for solar. In a step change, UAE conglomerate Al-Futtaim Group committed 10 billion Saudi riyals ($2.6 billion) to be deployed in various sectors from retail to automotives and real estate over the next three years, marking a rare plug from a UAE player during FII. |

|

On Nov. 12 at Cipriani South Street in New York, the Dubai Business Forum will convene CEOs, senior executives, and policymakers for a day of high-level conversations on global growth, AI disruption, and cross-border collaboration — examining the strategic opportunity Dubai provides for adaptive, forward-thinking companies. Featured speakers include H.E. Sultan bin Saeed Al Mansoori (Chairman, Dubai Chambers), Jose Minaya (Global Head, BNY Investments and Wealth), Jared Cohen (President of Global Affairs and Co-Head of the Goldman Sachs Global Institute, Goldman Sachs) and Ola Doudin (CEO, BitOasis). Request your delegate invitation here. The Dubai Business Forum USA, powered by Dubai Chambers, is produced in partnership with Semafor’s events and marketing teams, with select editorial sessions independently developed and led by Semafor’s newsroom. |

|

Aviation- Keeping it all in the PIF family, Riyadh Air will lease its first aircraft, a Boeing 787-9 Dreamliner, from AviLease.

Deals- XRG, the global investment arm of ADNOC, is considering an investment in an Argentinian liquefied natural gas project. XRG has acquired a stake in a Texas LNG plant and owns gas assets in Africa and Asia. — Bloomberg

- Mubadala Capital led a $1.4 billion funding round alongside Valor Equity Partners in Crusoe, tripling the valuation of the data center startup — which is building OpenAI’s first big data center in the US — to $10 billion in only a year. — Financial Times

Diplomacy- US President Donald Trump’s pick for ambassador to Kuwait is on course for rejection. Amer Ghalib’s nomination is under scrutiny from Republican lawmakers over, among other things, social media posts perceived as antisemitic. — The Washington Post

Government- The UAE approved its largest-ever federal budget, forecasting a balanced 92.4 billion dirhams ($25.2 billion) in revenue and spending next year, up 29% from 2025. — Emirates News Agency

Tech- Tabby was valued at $4.5 billion following a secondary share sale that added Chinese investors HSG and Boyu Capital, with the Saudi Arabia-based payments startup receiving no fresh capital in the deal.

Energy- Masdar won two solar contracts in Saudi Arabia — the 1.4 GW Najran and 600 MW Ad Darb plants — giving the UAE energy company 2 GW of new capacity as the kingdom aims to meet half of its energy needs through renewables by 2030.

|

|

A mock-up of Saudi Arabia’s first ultra-luxury train — “Dream of the Desert” — which will start service next year.  Courtesy of Future Investment Initiative Courtesy of Future Investment Initiative |

|

|