| | In this edition: African oil gets backers, Nvidia bets on Cassava, and what Ouattara’s victory means͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- Big oil is back

- Nvidia bets on Cassava

- Ouattara wins, again

- Mali’s fuel lockdown

- Domestic borrowing risk

- More development capital

Senegal’s annual pirogue regatta in Saint-Louis. |

|

African oil players expect funding |

| |  | Alexander Onukwue |

| |

Sodiq Adelakun/Reuters Sodiq Adelakun/ReutersCompanies operating in Africa’s oil and gas industry are gearing up to tap into a favorable financing environment for the sector, encouraged by US President Donald Trump’s pivot away from clean energy. Heirs Energies, a Nigerian firm owned by mogul Tony Elumelu, plans to double the output of its billion-dollar oil producing facility to 100,000 barrels per day within five years, and has started receiving interest from financiers, the company’s Chief Financial Officer Sam Nwanze told Semafor. Nwanze said there had been “a shift from international lenders wanting to focus once again on upstream oil and gas financing,” thanks to revived interest due to the change in Washington’s stance. Such investors have already enabled some big bets in Nigeria with the Dangote Refinery and Mozambique’s LNG projects. But the pivot is still in its early stages, say industry watchers. “For now it seems like a shift in tone around oil and gas financing more than a very clear trend: that could become more apparent come the new year,” said Clementine Wallop, analyst at Horizon Engage.

|

|

Cassava Technologies said it secured investment from US chipmaker Nvidia to help expand the pan-African group’s digital infrastructure services in the more than 30 African countries it operates in. Founded by Zimbabwean billionaire Strive Masiyiwa, Cassava’s subsidiaries provide a fiber optic cable network, data centers, cloud storage, and financial services across the continent. Both Cassava and Nvidia declined to comment on the nature and size of the investment. It comes after Nvidia’s valuation surged to nearly $5 trillion against the backdrop of soaring global investment in AI. Cassava — which is also present in the Middle East, Latin America, and the US — said in March that it would build an “AI factory” in Africa by deploying Nvidia’s artificial intelligence software at its data centers in Egypt, Kenya, Morocco, Nigeria, and South Africa. — Alexander |

|

Ouattara to keep economic momentum |

Luc Gnago/File Photo/Reuters Luc Gnago/File Photo/ReutersAnalysts predicted Côte d’Ivoire will maintain its decade-long economic momentum after President Alassane Ouattara won a fourth term in weekend elections. Despite presiding over a period of relative prosperity — the country’s annual GDP growth reached 6.4% this year — authorities’ suspension of major opposition candidates, including former Credit Suisse chief Tidjane Thiam and former Ivorian President Laurent Gbagbo, had risked tipping the country into unrest. Capital Economics, for example, projects growth will accelerate to 6.8% in 2027. Time is not on the 83-year-old leader’s side, though: “Ouattara will have a lot to prove,” an analyst at think tank Chatham House said. “He certainly will not want his mostly positive track record to be tarnished by a perceived slide into ageing, complacency or stagnation, occupying a purely symbolic role while his ministers make the real decisions.” — Paige Bruton |

|

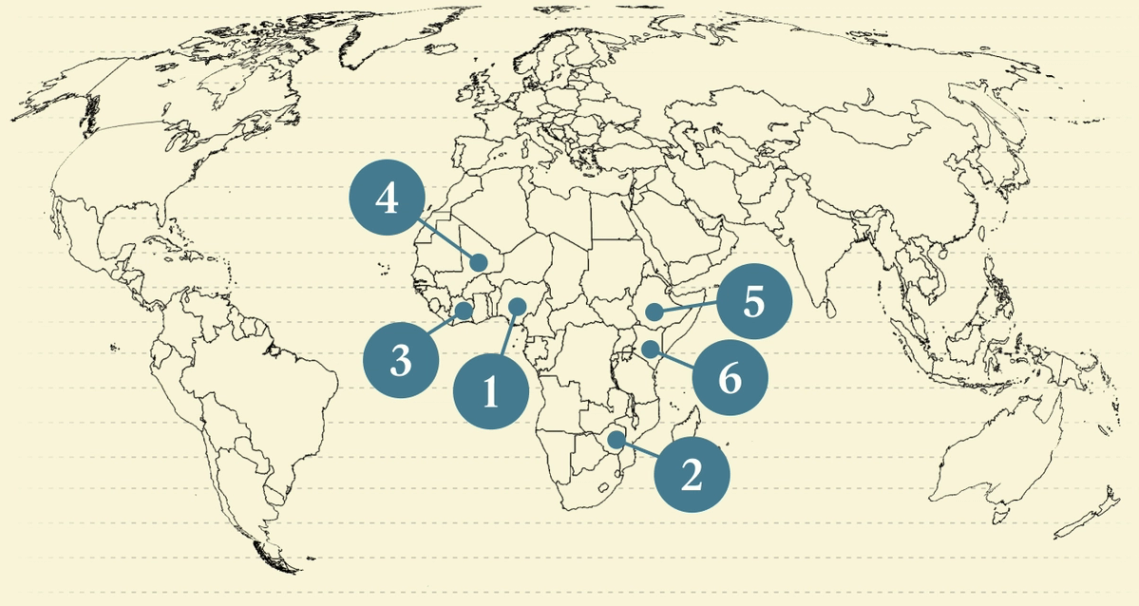

Jihadist blockade fuels Mali tensions |

Idriss Sangare/Reuters Idriss Sangare/ReutersMali’s ruling junta responded to an al-Qaida affiliate’s fuel blockade by shuttering all schools until mid-November, the latest sign of instability in the West African country. The month-long blockade by the JNIM armed group has set off long queues at petrol stations in Bamako and other major cities, grinding economic activity to a halt. JNIM has orchestrated multiple attacks in Mali since July, targeting trade channels with neighbors Côte d’Ivoire, Mauritania, and Senegal. The group is in control of more Malian territory “than at any other previous time” during its decade-long insurgency, according to the Africa Center for Strategic Studies, a Washington DC think tank. On Tuesday, the US advised Americans to leave the country immediately, citing security “unpredictability.” |

|

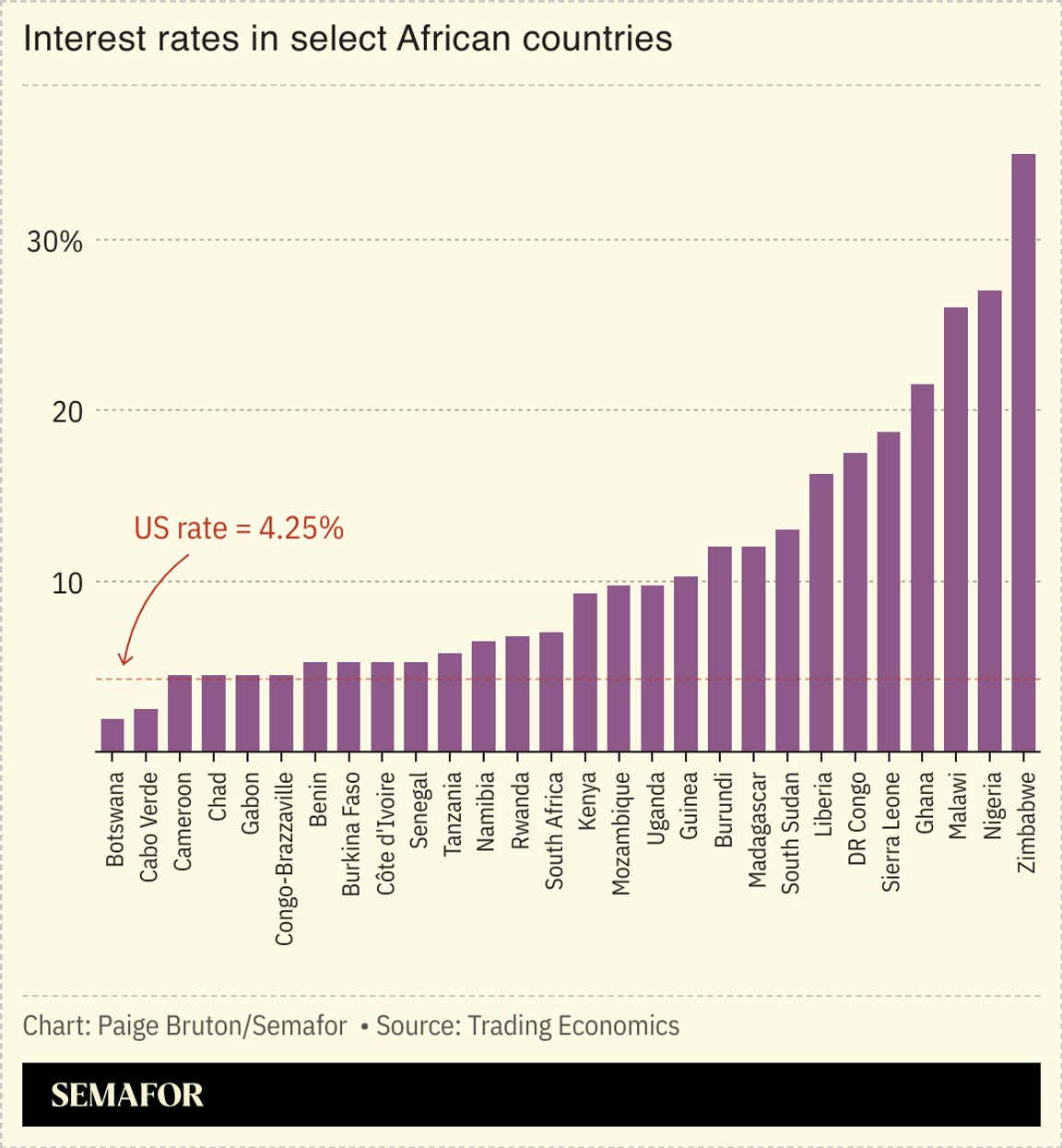

Domestic borrowing surges |

Sub-Saharan African governments are increasingly turning to domestic rather than foreign banks for loans, a new IMF report said. While this leaves nations less exposed to foreign exchange volatility, domestic borrowing is expensive on account of high interest rates across much of the continent. “Local financial markets are underdeveloped,” the IMF said, voicing concern that if governments struggle to service their debt, they could find themselves in a “vicious potential feedback loop,” threatening banks and heightening a country’s fiscal stress. The report also warned that overuse of domestic banks could crowd out private sector investment. However, the IMF also highlighted that sub-Saharan Africa is faring better in the face of global trade upheaval than the fund had previously predicted. Economic growth in the region is predicted to hold steady at 4.1% in 2025, compared to 3.2% globally. — Paige |

|

S&P unlocks more development funds |

The additional amount that African development banks could unlock this year, after S&P Global Ratings updated its framework for multilateral lenders. The change comes as several development finance institutions have increased their capital buffers, allowing S&P to raise its risk-adjusted capital ratios by about 10%, the agency said. Development banks are seen as increasingly central to plugging financing shortfalls in African countries as international aid programs pull back from the continent. Global lending by development banks rose 4% between 2021 and 2024, with Africa accounting for 19% of the total, Reuters reported. |

|

As one of Africa’s most industrialized economies and a G20 member, South Africa plays a pivotal role in advancing digital and financial inclusion across the region. With a strong financial infrastructure and growing global influence through the B20 and G20, the country is well-positioned to drive the next wave of innovation and access. Join Semafor in Johannesburg for The Next 3 Billion Tour, as we examine how South Africa’s leadership can help scale inclusive solutions across borders — from interoperable digital payments and cross-regional investment to expanding connectivity. Nov. 18 | Johannesburg | Request Invite |

|

Business & Macro |

|

|