| | In this edition, why words from the biggest tech execs can’t plug AI bubble leaks, and Warner Bros. ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Gail Slater’s hot seat

- PayPal’s bank shot

- Uphill year for big activists

- Gulf’s leisure bet

- Econ data is back, and not great

Bitcoin’s Caribbean legal utopia … |

|

The AI bubble is starting to leak, and the industry’s frontmen are doing a lousy job plugging the holes. Genuine questions about the pace of spending has fueled steep stock-price slides from CoreWeave and Oracle, which together have lost $400 billion in market value, about 40%, since mid-October. But mixed messages and rookie mistakes from Silicon Valley executives have fueled those concerns, and given the sense that neither this technology nor the companies developing it are ready for primetime. Sam Altman got huffy when a friendly tech investor asked him an obvious question — how OpenAI would pay for the $1.4 trillion in spending commitments it’s made. His chief financial officer, Sarah Friar, stepped in it a few days later when she suggested the government should “backstop” AI investments, a statement Altman then had to walk back. CoreWeave’s CEO misspoke on the extent of data-center delays on a recent earnings call, forcing his own CFO to clarify — then repeated the mistake on Jim Cramer’s show. Larry Ellison might have made an exception to his no-interviews approach as Oracle’s stock cratered. This technology is changing fast. Humans misspeak. There are always construction delays. (CoreWeave’s were weather-related, according to The Wall Street Journal.) But a generation of CEOs used to acting, and being treated, like small gods, seem unused to the everyday crises of running a business. What will happen when they face real crises? |

|

Gail Slater. Mattie Neretin/CNP/Sipa USA. Gail Slater. Mattie Neretin/CNP/Sipa USA.The bidding war for Warner Bros. Discovery may hinge on a lawyer with an unusual depth of experience in media and tech: Justice Department antitrust chief Gail Slater. Members of both parties are urging close scrutiny of Netflix’s deal and a competing hostile bid from Paramount, and Hollywood stars and unions worry a merger will mean less competition. President Donald Trump’s intense interest in the fate of CNN threatens to undercut Slater’s review before it officially started. Slater has been in the hot seat before in Trump’s politicized Washington; two of her deputies quit earlier this year after what they said was undue influence by MAGA figures meddling in a Big Tech takeover. And she has other high-stakes decisions to make, notably whether to appeal a ruling in the case against Google as the administration tilts toward Big Tech. She is, an ally says, an “idealist” and possibly “not corrupt enough for this world.” Fast-changing industries like tech and media are a particularly soft spot for antitrust regulators, whose reviews — snapshot at best and backward-looking at worst — can miss coming shifts. (Case in point: the bankruptcy filing this week of the maker Roomba vacuums, whose acquisition by Amazon was blocked by Biden’s antitrust watchdogs and sold instead to a Chinese supplier.) But it’s worth noting that while Slater is best known as then-Sen. JD Vance’s top economic policy adviser, she’s also a former executive at Fox, Roku, and until 2018, as a top executive at lobby group Internet Association. |

|

Kris Tripplaar/Semafor Kris Tripplaar/Semafor“It’s not the plan,” PayPal’s CEO said in April when Semafor asked him whether the fintech giant planned to turn itself into a regulated bank. “We’ve kept it very balance-sheet-light, and we’ll let banks do what banks do really well.” Fast forward eight months and PayPal is becoming a bank. The company applied to Utah’s state regulators for a slimmed-down license that would allow it to take federally insured deposits and make loans to its business customers, “reducing reliance on third parties.” Fintech players that launched proudly as antibanks — content to peel away their customers and avoid the regulatory overhead — have instead joined them, including SoFi, Varo, Lending Club, and Revolut. It’s an odd fixture of the lending economy, given the vast pools of nonbank money available. Robinhood considered the move in 2019 but decided against it, CEO Vlad Tenev told Semafor last year, because “the government does not want banks to grow quickly.” But he said the company is “not ideologically opposed” and may reconsider as it ramps up its credit card business, which is currently white-labeled by a community bank in Washington state. (A Robinhood banking pivot is on our 2026 bingo card, which we’ll be bringing to you later this month.) Meanwhile, a handful of crypto companies including Circle last week got conditional licenses to become trust banks, meaning they can’t take deposits or make loans but have access to other parts of the financial system. After the Biden administration failed to approve a single fintech bank charter application, Trump has “rolled out the welcome mat,” Michele Alt, a partner at fintech consultancy Klaros, tells Semafor. New applications are at their highest levels since 2020. |

|

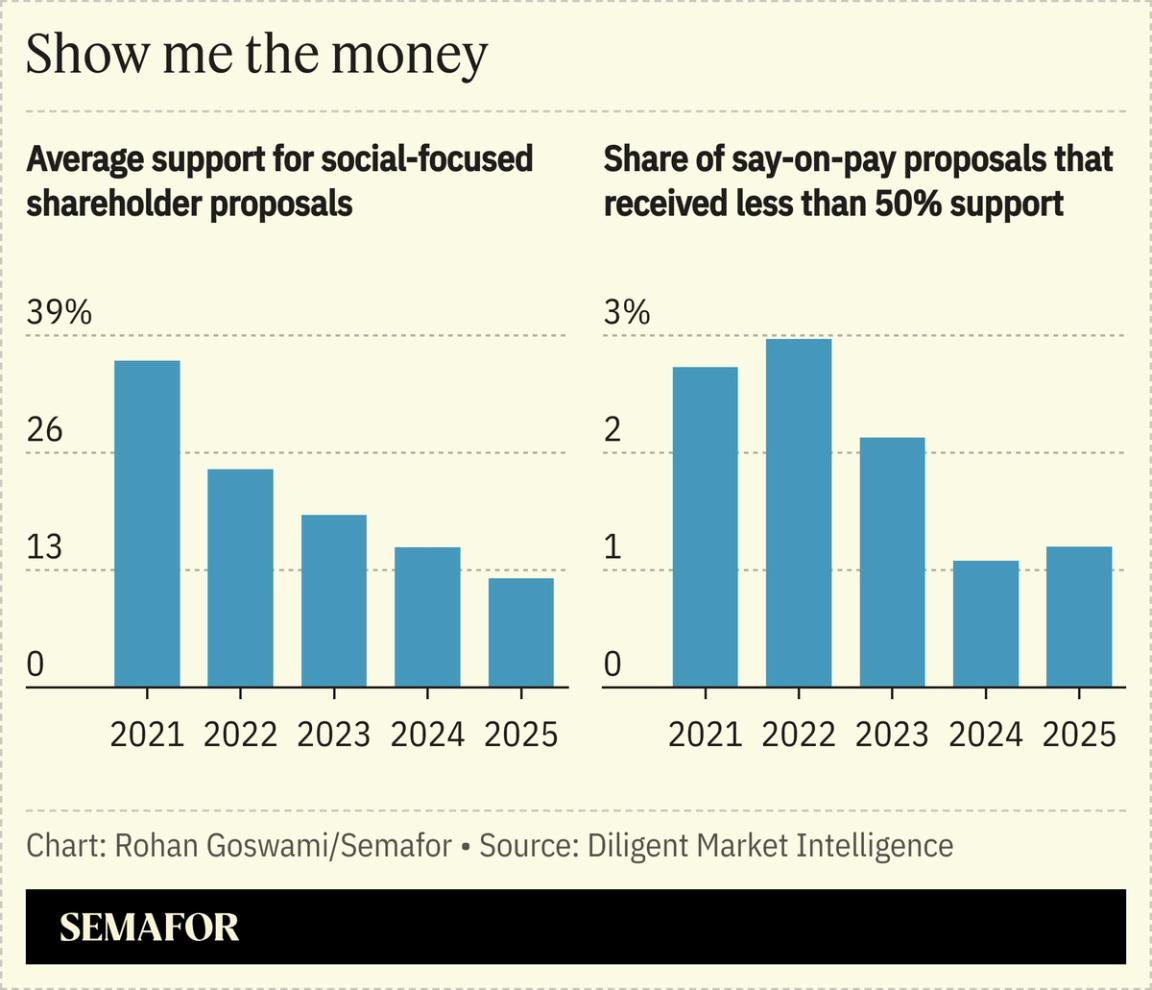

Activist investors are losing the Big Three |

BlackRock, State Street, and Vanguard offered slim support to activist nominees at proxy fights this year. A new report from data provider Diligent shows that those three firms, whose roughly 20% ownership of the US stock market gives them huge power in corporate elections, overwhelmingly backed incumbent board members. Vanguard voted for just 8.6% of dissident nominees who sought board seats at Russell 3000 companies. State Street backed 11%, and BlackRock backed 14%. (State Street declined to comment. Vanguard and BlackRock didn’t return requests for comment.) |

|

Gulf cash is coming for US eyeballs |

Mike Blake/File Photo/Reuters Mike Blake/File Photo/ReutersTo understand the flood of Gulf money pouring into Hollywood, may we suggest a primer on Maslow’s Hierarchy. In the techno-optimist view of Middle Eastern governments, AI revolutionizes our lives: Workers become more productive and richer, the working week gets shorter, and we all get healthier and live longer. That will leave us with more leisure time — and more money to spend enjoying ourselves. Emirati, Qatari, and Saudi funds joining forces to back Paramount Skydance’s $108 billion hostile takeover offer for Warner Bros. Discovery wasn’t just a rare display of cooperation in a region more characterized by economic competition — it was the biggest display of their willingness to put their financial resources behind this investment thesis. A similar strategy is behind Saudi Arabia’s Public Investment Fund leading the mega-buyout of Electronic Arts, a deal that shocked many Saudi watchers who thought the kingdom was reining in its overseas investments. But conviction in the region is high that the next wave of giant companies will not come from pumping oil, but from capturing eyeballs. — Matthew Martin |

|

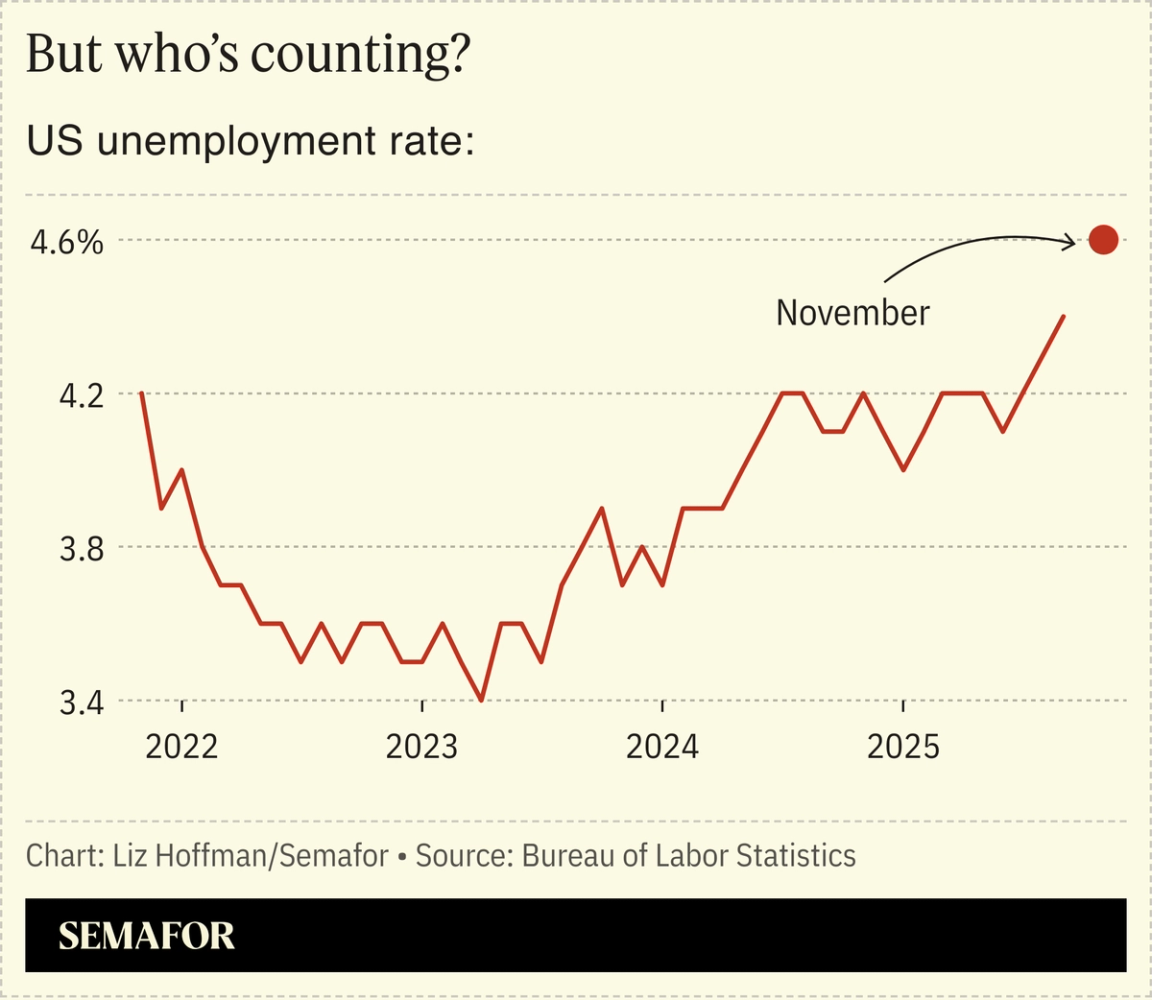

Economic data is back, but not great |

US companies stuck to their “low-hiring, low-firing” stance in November, sending the unemployment rate to its highest level since 2021. The data, released this morning, are the first since September and were eagerly awaited by investors and policymakers who’d been operating in a blackout due to the longest government shutdown in history.  The 64,000 jobs added by the private sector was better than expected. But this year’s job growth has come from health care and private education, not the manufacturing sector the White House champions. “Somehow creating massive uncertainty around the price of imported inputs didn’t create a jobs boom,” one left-leaning economist notes. The Fed is in a tricky spot, with inflation stubbornly high and unemployment also rising. That has stoked dissent inside the Fed’s rate-setting committee. “My worry is that if we remain too tight for too long, we’re going to exert too much restriction on the labor market and the unemployment rate will move too high,” Fed Gov. Stephen Miran, who dissented from last week’s rate cut, told CNBC. Compare that to what Fed Chair Jerome Powell said after that meeting: “We are well positioned to wait and see how the economy evolves.” |

|

Tired of financial newsletters that bury the lead, or worse... don’t have one? That’s why more than 1 million investors start their day with The Daily Upside. Written by former Wall Street insiders, it cuts through the noise with actionable market insights that actually matter. Subscribe for free and stay ahead. |

|

➚ BUY: Smelt it. The US government is backing plans by a Korean metals processor to build a smelter in Tennessee, in an attempt to counter China’s hold on the supply of critical minerals. ➘ SELL: Dealt it. Carvana bought a car dealership in Atlanta as it branches out beyond online brokering and takes on showrooms IRL. |

|

Companies & Deals- In kind: OpenAI won’t pay a penny to license Disney characters for use on its video-generation platform Sora — the deal is fully in stock warrants, Bloomberg reports.

- Running on empty: Ford is taking a $19.5 billion hit to scale back its electric-car lineup and focus on gas and hybrid models. Trump’s cancellation of an EV tax credit had already forced an expensive retreat at General Motors.

- Rocky road: Magnum, Unilever’s newly spun-out ice cream business, is removing three members of Ben & Jerry’s board, escalating a long-running legal fight over progressive stances.

- Trusted recipe: Kraft Heinz hired breakup artist Steve Cahillane as CEO, who steered Kellanova through its split, as it prepares for a messy spinoff of its own.

Watchdogs- You’re fired: Trump sued the BBC for $10 billion over the editing of a documentary it broadcast last year that gave the impression the president was calling for violence ahead of the Jan. 6 Capitol riot.

- No guarantees: US tariff revenue hit $200 billion this year. The US Treasury would be forced to refund much of that if the Supreme Court rules Trump exceeded his authority in imposing them, an outcome that prediction markets are putting at 60% likelihood.

|

|

|