| | Geopolitics and oil mix when it comes to Iran, Cuba, and Venezuela, while a Canadian firm announces ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Oil prices surge on Iran

- US levers oil on Latam

- New battery progress

- EVs outpace petrol in Europe

- Fossil M&A concentration

One new environment treaty comes into force, while the US leaves another. |

|

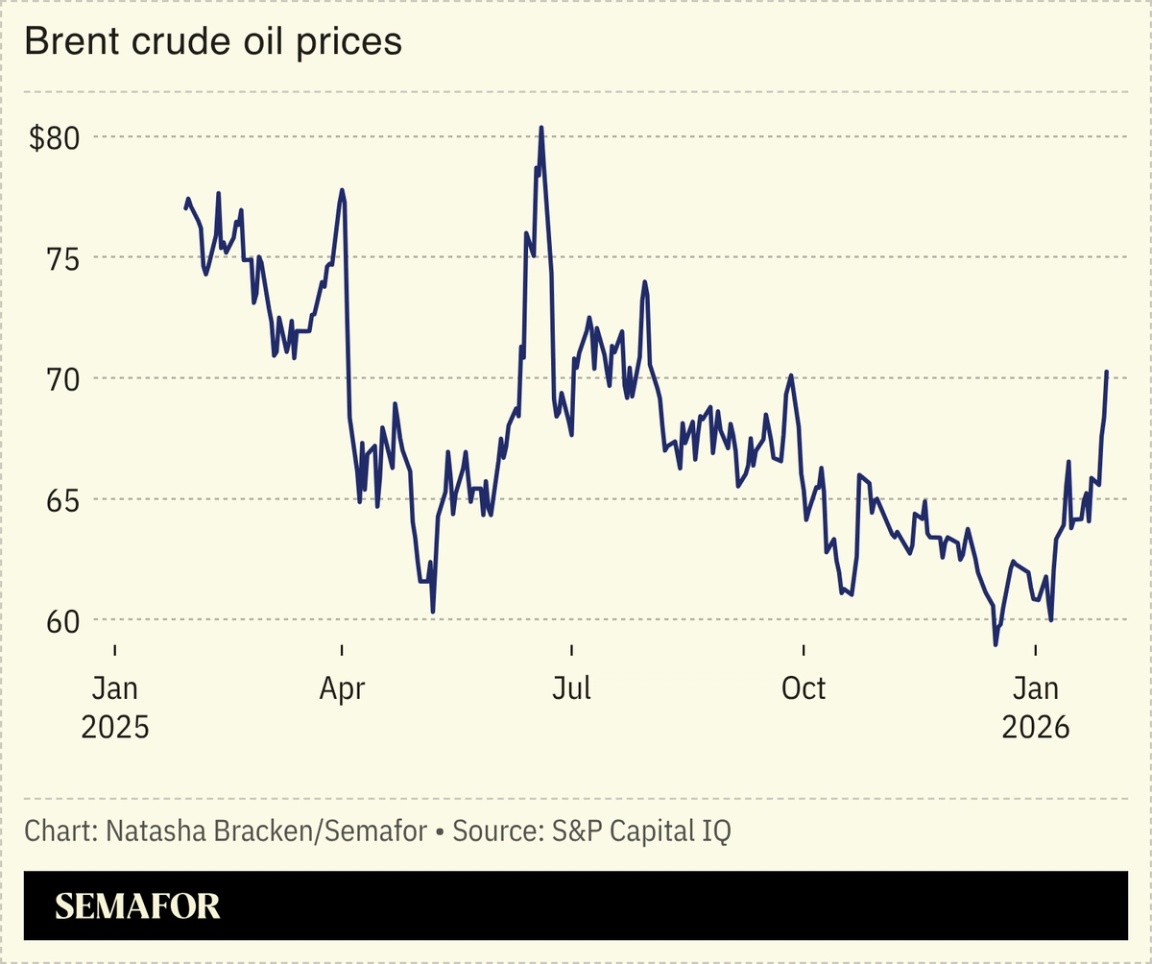

Growing signs that the US may be readying fresh strikes on Iran drove oil prices higher, but traditional crude producers may reap limited rewards from the increase. US President Donald Trump has warned of a “massive Armada” heading to Iran, adding that “time is running out” for the country’s leaders to agree a deal over its nuclear program, while Iran’s foreign minister has hit back that Tehran’s forces had their “fingers on the trigger”: CNN reported that Trump was weighing strikes because of limited progress in nuclear talks; the president had previously threatened a military response over Iran’s crackdown on protesters, but later backed off. The oil market response was in one sense predictable: Brent crude hit $70 a barrel for the first time since September, largely because a US military intervention could itself threaten crude production. Were Iran to respond by limiting access to the Strait of Hormuz — something it has previously threatened — prices could skyrocket, though as Semafor’s Gulf editor noted, regional producers wouldn’t necessarily benefit because their crude would likely be stranded. |

|

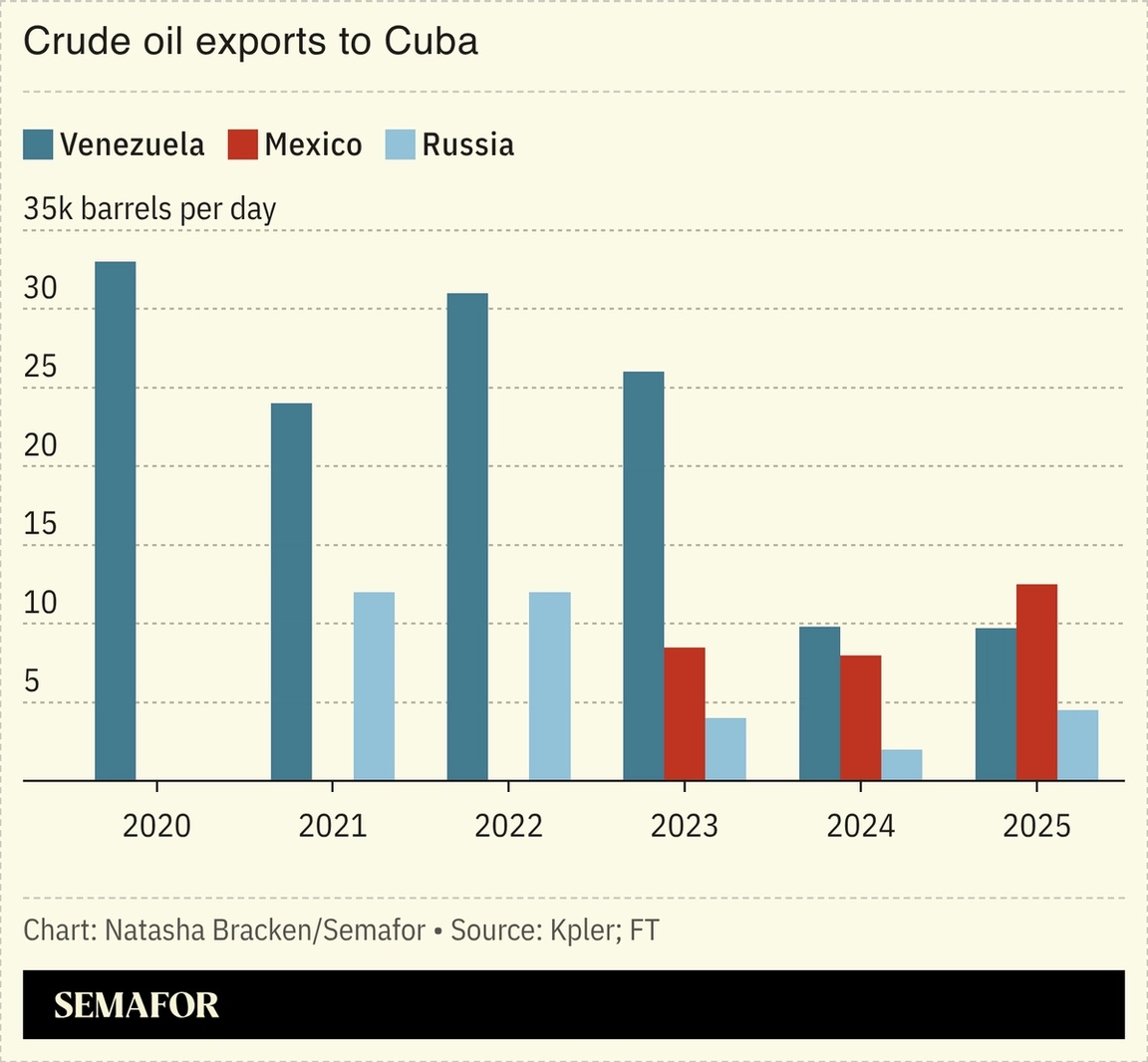

The US intensified pressure on Cuba and Venezuela, in each case by leveraging its dominance of oil exports. Mexico cancelled an oil shipment to Cuba following pressure from the US: Since Washington captured Nicolás Maduro, oil shipments from Venezuela to Cuba have plummeted, leaving Mexico as Havana’s biggest crude supplier. But the White House has urged Mexican President Claudia Sheinbaum to cut oil sales, with US President Donald Trump indicating he is looking to see the regime in Cuba fall. Sheinbaum nevertheless defended the move to halt oil deliveries as a “sovereign decision.” US Secretary of State Marco Rubio, meanwhile, showcased US control of Venezuela’s crucial oil exports less than one month after Washington ousted Maduro, testifying to a Senate committee that Caracas will have to submit a monthly budget, and the Trump administration’s review will determine how the funds from oil proceeds can be spent. The unusual arrangement has drawn comparisons to Iraq’s reconstruction, in which the US took control of Baghdad’s oil fund and lost track of $8.7 billion, Politico noted. |

|

TransAlta/Handout via Reuters TransAlta/Handout via ReutersA Canadian-headquartered battery manufacturer announced a major advancement in the capacity of its storage products, saying they now surpassed those of Chinese rivals that dominate the sector. NEO Battery Materials said in a release first shared with Semafor that its drone batteries achieved a 50% capacity improvement over similar products made by competitors, and said its efforts were key to “addressing critical supply chain concentration and security concerns.” The company says it is making inroads with potential military clients, including the South Korean government — Seoul’s defense sector is among the world’s biggest — and is rolling out products for automotive customers, too. The global energy storage sector is dominated by Chinese companies, notably battery maker CATL and EV giant BYD, with the country’s energy storage association reporting a 144% increase in orders in 2025 compared to the prior year, amplifying concerns among Western customers of growing reliance on the country. — Prashant Rao |

|

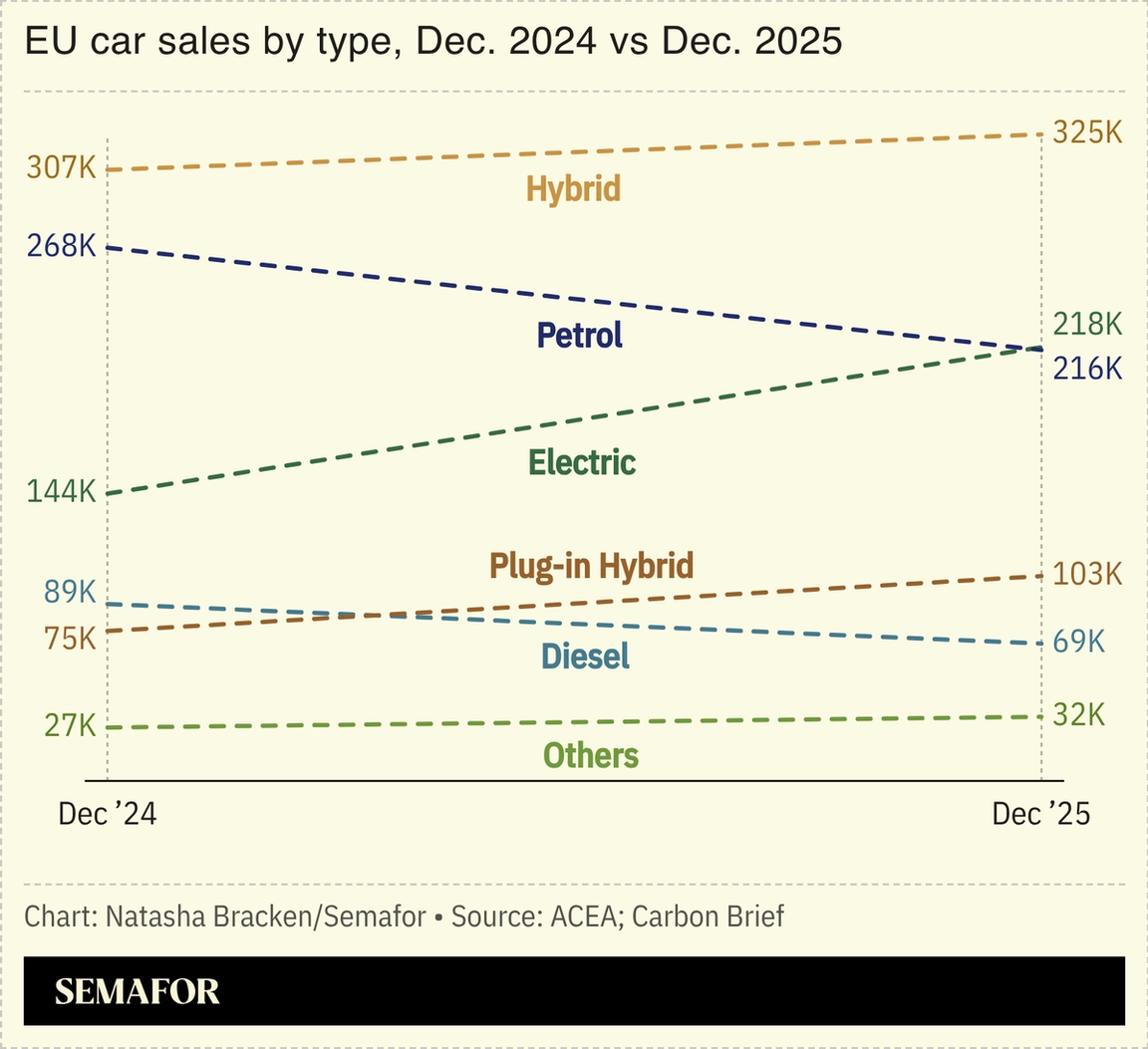

EVs outpace petrol in Europe |

Sales of all-electric vehicles overtook gasoline-only ones in Europe for the first time in December, boosted by an influx of low-cost Chinese models. The shift comes despite a 38% drop in Tesla sales in 2025 as the Elon Musk-led carmaker lost ground on the continent to China’s BYD. The EU is planning to allow more China-made EVs into Europe as part of efforts to lower diplomatic and trade tensions with Beijing, while Canada, too, has lowered its levies on Chinese-manufactured electric cars as part of a deal agreed during Canadian Prime Minister Mark Carney’s visit to Beijing. EV sales also boomed in the US last year, but American automakers are reining in electrification plans amid the Trump administration’s rollback of EV incentives. For Washington, the growth of EV trade elsewhere “should be taken as a serious signal of future global trends,” a CSIS analyst argued. |

|

Shemara Wikramanayake, Managing Director & CEO, Macquarie Group, is joining the Semafor World Economy Global Advisory Board — a forum of visionary business leaders guiding the largest gathering of global CEOs in the US. The expanded board represents nearly every sector across the US and G20. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

Angus Mordant/Reuters Angus Mordant/ReutersOil and gas dealmaking is concentrating around a small number of players who capture outsized returns, driven by consolidation among frequent buyers, a new report found. The top 20 acquirers in the last 10 years accounted for 53% of total deal value, and companies that complete at least one acquisition per year now generate total shareholder returns 130% higher than peers that do not complete any deals — more than double the performance gap seen a decade ago, research by the consulting firm Bain & Co found. Mergers tend to allow companies to capture scale and reduce unit costs through operational efficiencies and consolidated infrastructure, savings that have become more important now that oil prices have retreated from their 2022 peak. — Natasha Bracken |

|

New Energy Muyu Xu/Reuters Muyu Xu/ReutersFossil FuelsPolitics & Policy- The US officially left the Paris climate agreement, again, fulfilling a pledge President Donald Trump made upon returning to office last year.

- The High Seas Treaty, which sets global obligations on the use of ocean resources, came into force.

- A US federal judge said that a nearly completed offshore wind project could continue work, making it the fourth to receive permission to proceed since Trump ordered five projects to halt operations.

Minerals & Mining- Gold, silver, and copper hit record highs on geopolitical turmoil and industrial demand.

EVs- Tesla plans to scrap two EV models and instead invest more in robotics and AI as the company saw its first drop in annual revenue.

|

|

|