| | In today’s edition: Sovereign fund shakeup in Abu Dhabi, and Semafor columnist Amena Bakr on the pro͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Abu Dhabi SWF shuffle

- Lunate appoints CEO

- IHC’s big ambitions

- Gulf urges Iran de-escalation

- Tech VCs head to Doha

- Libya oil > Venezuela

Egypt navigates Gulf rift, and other weekend reads. |

|

A crown jewel for the Crown Prince |

Emirates News Agency-WAM Emirates News Agency-WAMAbu Dhabi is rolling its $263 billion fund ADQ into the newly formed L’IMAD, as the Emirate aims to create a sovereign investment powerhouse under its crown prince, Sheikh Khaled bin Mohamed bin Zayed Al Nahyan. L’IMAD — which burst onto the scene late last year, first acquiring real estate assets and then backing Paramount Skydance’s bid for Warner Bros. Discovery — plans to invest in the UAE and internationally, targeting a wide range of sectors, including infrastructure, real estate, financial services, advanced industries and technologies, and urban mobility. ADQ’s holdings dovetail with those ambitions: Its assets include Etihad Airways, Emirates Nuclear Energy Company, and the Abu Dhabi stock exchange ADX. It has been chaired by Sheikh Tahnoon bin Zayed, who was not named in Friday’s announcement about L’IMAD. Abu Dhabi’s deputy ruler also chairs the UAE’s largest sovereign wealth fund, the $1 trillion Abu Dhabi Investment Authority, as well as technology investment vehicle MGX and listed conglomerate International Holding Co. — Kelsey Warner |

|

Courtesy of ADGM Courtesy of ADGMThe head of ADQ stepped down to take over at UAE alternative asset manager Lunate the day before ADQ was rolled into Abu Dhabi’s newest sovereign wealth fund, L’IMAD. Mohamed Hassan Alsuwaidi — also the UAE’s investment minister — was named executive chairman and managing partner of Lunate, which manages about $115 billion. Since its launch in 2023, Lunate has grown quickly, taking a minority stake in hedge fund Brevan Howard, and creating investment platforms with Brookfield and Blue Owl. It’s also invested in OpenAI and cloud-computing firm CoreWeave. Like other prominent UAE investors, it is increasingly raising money from third parties. Alsuwaidi was closely involved in the launch of Lunate, which had ADQ and Chimera Investment — both connected to Abu Dhabi Deputy Ruler Sheikh Tahnoon bin Zayed Al Nahyan — as anchor limited partners. Announcing Alsuwaidi’s new position, Lunate managing partners Khalifa Al Suwaidi, Murtaza Hussain, and Seif Fikry pointed to his “ability to build at scale [and] attract global capital.” — Matthew Martin |

|

IHC’s $125 billion growth plan |

Courtesy of IHC/Joey Pfeifer/Semafor Courtesy of IHC/Joey Pfeifer/SemaforThe blandness of International Holding Company’s name belies the boldness of its ambitions. Founded as a fish farming business in the 1990s, IHC has grown into Abu Dhabi’s largest listed firm. In an interview with Semafor’s CEO Editor Andrew Edgecliffe-Johnson, IHC’s CEO Syed Basar Shueb said the firm plans to deploy up to $2 billion a month in fresh capital, aiming to double in size by 2030 from about $125 billion in assets. The conglomerate’s challenge is turning a sprawling portfolio into something greater than the sum of its parts. IHC’s answer is to build what it calls “dynamic value networks.” After opening a mine, for example, it might add a school, a hospital, and a sports center to support a growing community. |

|

Gulf favors US-Iran talks over conflict |

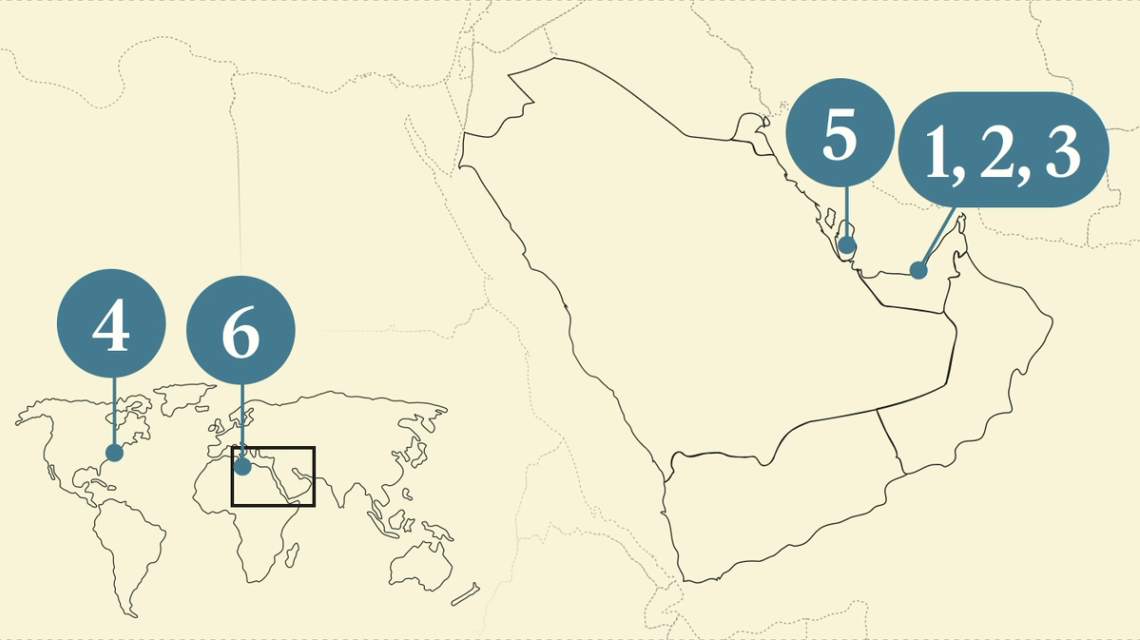

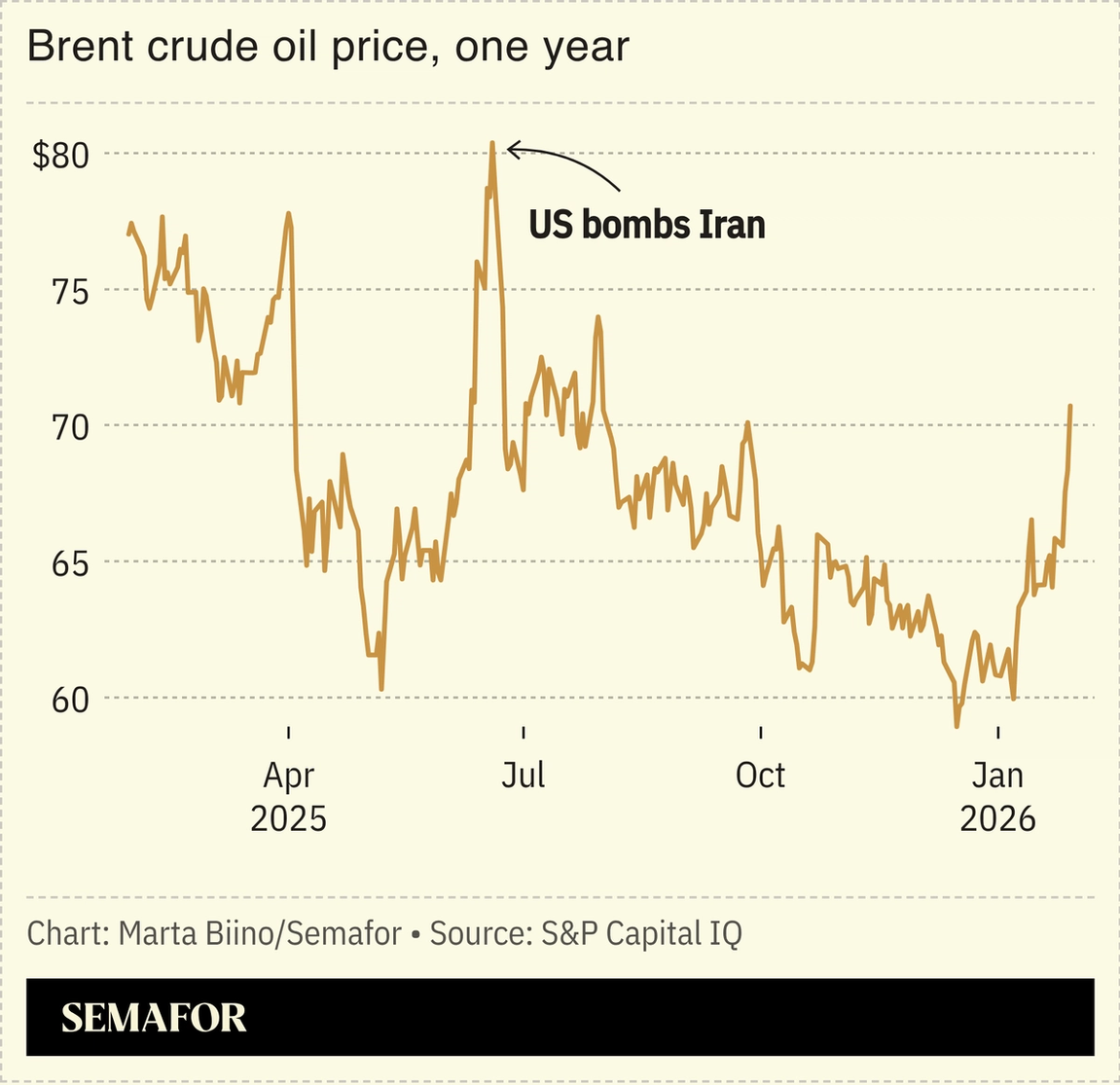

Gulf states are ramping up diplomatic efforts to avert a US strike on Iran that could spill across the region. Saudi Defense Minister Prince Khalid bin Salman is in Washington for talks with the Trump administration. Qatar and Oman have also been engaging both sides, while Türkiye is hosting Iran’s foreign minister. Saudi Arabia and the UAE have both publicly said they will not allow their airspace or territory to be used for an attack on Iran. The rhetoric from Washington and Tehran — and US military deployments, including the recent arrival of aircraft carrier USS Abraham Lincoln in the Middle East — appears to signal confrontation, and many airlines have canceled flights to the Gulf over the past week. Crude is up almost 15% this year, with Brent hitting $70 a barrel for the first time since July. While that’s a boost for exporters, leaders in the region are concerned that broader economic disruption from a conflict would outweigh the extra income. — Mohammed Sergie |

|

Courtesy of Web Summit Qatar Courtesy of Web Summit QatarSome 1,600 startups are expected to flock to Doha for Qatar’s Web Summit next week to hobnob with developers and investors. More than 30,000 attendees — including executives from Snap, TikTok, Uber, and Meta, as well as the $580 billion Qatari sovereign wealth fund — are due at the annual gathering, double the number at the first Gulf edition of the international tech confab in 2024. The gas-rich nation has taken a more cautious approach than neighboring Saudi Arabia or the UAE to investing in artificial intelligence, but its technology and startup scene are on the rise: Venture investing was up 81% last year, with more than 9 out of 10 deals going to seed-stage companies, according to Magnitt. Qatar Investment Authority’s AI arm, Qai, has a $20 billion AI infrastructure fund with Brookfield. |

|

View: Why Libya beats Venezuelan oil |

An oil field in Libya. Jawhar Deehoum/Reuters. An oil field in Libya. Jawhar Deehoum/Reuters.As US President Donald Trump pushes US oil companies to revive Venezuela’s energy sector, Libya is emerging as the more attractive destination, writes Amena Bakr, head of Middle East Energy & OPEC+ research at global commodities data firm Kpler, in a Semafor column. During a visit to Tripoli, energy executives uniformly said they preferred to invest in Libya, Bakr wrote. “Venezuela’s tar-like crude can cost between $60 and $80 a barrel to produce, while production costs in Libya are typically under $10 a barrel. Infrastructure in Venezuela is severely degraded, and any meaningful revival would likely require more than $100 billion in investment over a decade.” |

|

In 2026, the World Governments Summit will convene under the theme “Shaping Future Governments.” This summit will bring together governments, international organizations, thought leaders, and private sector leaders from around the globe to foster international cooperation and identify innovative solutions for future challenges, ultimately inspiring and empowering the next generation of governments. Learn more here. |

|

Diplomacy- UAE President Sheikh Mohamed bin Zayed Al Nahyan held talks with Russia’s President Vladimir Putin in Moscow on Thursday, focused on bilateral economic ties, the Ukraine war, and tensions in the Middle East.

Economy- Saudi Arabia’s Public Investment Fund and Ministry of Investment are encouraging some of the country’s wealthiest families to help fund project spending in the kingdom and draw in more international capital. — Bloomberg

Finance- The investment banking arm of Dubai-based Emirates NBD secured a merchant banking license in India, a first for a UAE lender. The bank will be able to pitch for Indian IPOs and debt sales, and channel capital into India’s markets.

Real Estate- Ras Al Khaimah sent a trade delegation to China and Hong Kong in a bid to attract more foreign investment and promote a new Wynn Resort, the UAE’s first casino. — South China Morning Post

- Saudi Arabia drew some big names, with little industry experience, to a real estate conference: Hillary Clinton and Tucker Carlson praised the kingdom’s changes, with Carlson urging the country not to legalize alcohol and expanding on finding Jesus at a late age. — The New York Times

|

|

- Egypt can’t afford to choose sides between Abu Dhabi and Riyadh. Cairo will have to maintain relations with the UAE to keep its economy afloat while moving closer to Saudi Arabia on regional security issues, Haisam Hassanein writes for the Washington Institute for Near East Policy.

- Jewelers and auction houses are paying more attention to the Gulf, where young buyers, influencer-led ta

|

|

|