| | In this edition: Mozambique gas project revived, startup fundraising trends, and a new AI deal betwe͏ ͏ ͏ ͏ ͏ ͏ |

| |   Maputo Maputo |   Antananarivo Antananarivo |   Niamey Niamey |

| Africa |  |

| |

|

- TotalEnergies revives project

- Madagascar ends permit ban

- Niger airport attack warning

- Startups normalize debt

- Google-Ghana’s AI deal

- Weekend Reads

A film adaptation of a bestselling Nigerian novel. |

|

Capital flows into Africa have slowed drastically after some seismic shifts. The most obvious upheaval was Washington’s shuttering of USAID, the impact of which has been compounded by other Western countries slashing their own development budgets. And the continent has seen a sharp contraction in new lending from China in recent years. With pressure growing on many African governments to deliver everything from health programs to infrastructure projects, who will plug the gaps? The answer increasingly looks like multilateral development banks. The African Development Bank, World Bank, and New Development Bank were among lenders that stepped in to help governments during the COVID-19 pandemic. And they have largely continued to provide vital support. Analysis by ONE Data — a partnership between Google and the ONE Campaign advocacy group — found multilateral financing surged 124% between 2010-2014 and 2020-2024, with these lenders now accounting for more than half of net flows into Africa compared to barely a quarter a decade earlier. This matters because these institutions will increasingly determine the continent’s economic development, and because a reliance on these lenders only gives credence to the idea that an unfair risk premium is placed on those trying to raise capital for projects in Africa. The tension is at the heart of the row between Afreximbank and Fitch, which this week saw the continent’s trade bank end its relationship with the ratings agency. It’s also why it was particularly striking that ratings agency S&P this week assigned an A credit rating, with a positive outlook, to the Africa Finance Corporation, which provides financial backing to infrastructure projects across the continent. AFC’s new rating will reduce its cost of securing capital at a time when lost funding, tied to Washington’s withdrawal from multilateralism, is being felt on the continent. It puts the bank, like other MDBs, in an increasingly pivotal position. “We’re already experiencing that growing role,” Samaila Zubairu, the AFC’s president and CEO, told me. As the full extent of Western development cuts hit home, this will be the year that pressure on MDBs to deliver increases. |

|

Mozambique gas project to restart |

Stephanie Lecocq/File Photo/Reuters Stephanie Lecocq/File Photo/ReutersMozambique and French oil giant TotalEnergies agreed to restart a $20 billion natural gas project, thanks to improving security in the southern African nation. Construction was halted in 2021 following a spate of Islamist attacks along Mozambique’s coast, home to some of the world’s largest gas reserves. Another project led by ExxonMobil was also paused five years ago, but is now slated to begin construction after a deployment of Rwandan soldiers weakened the militias. Progress at either site could be a boon for the country, where almost 80% of the population lives in poverty. Mozambican President Daniel Chapo estimates the Total project alone could generate as much as $35 billion for government coffers over its lifetime. The projects have “raised hopes that Mozambique… could become an African version of wealthy Qatar,” AFP reported. But such projects often take several years to make a positive economic impact: More than a decade ago, the BBC reported that Mozambique had “hit the jackpot” with its gas reserves. |

|

Mining ban lifted, minerals deal signed |

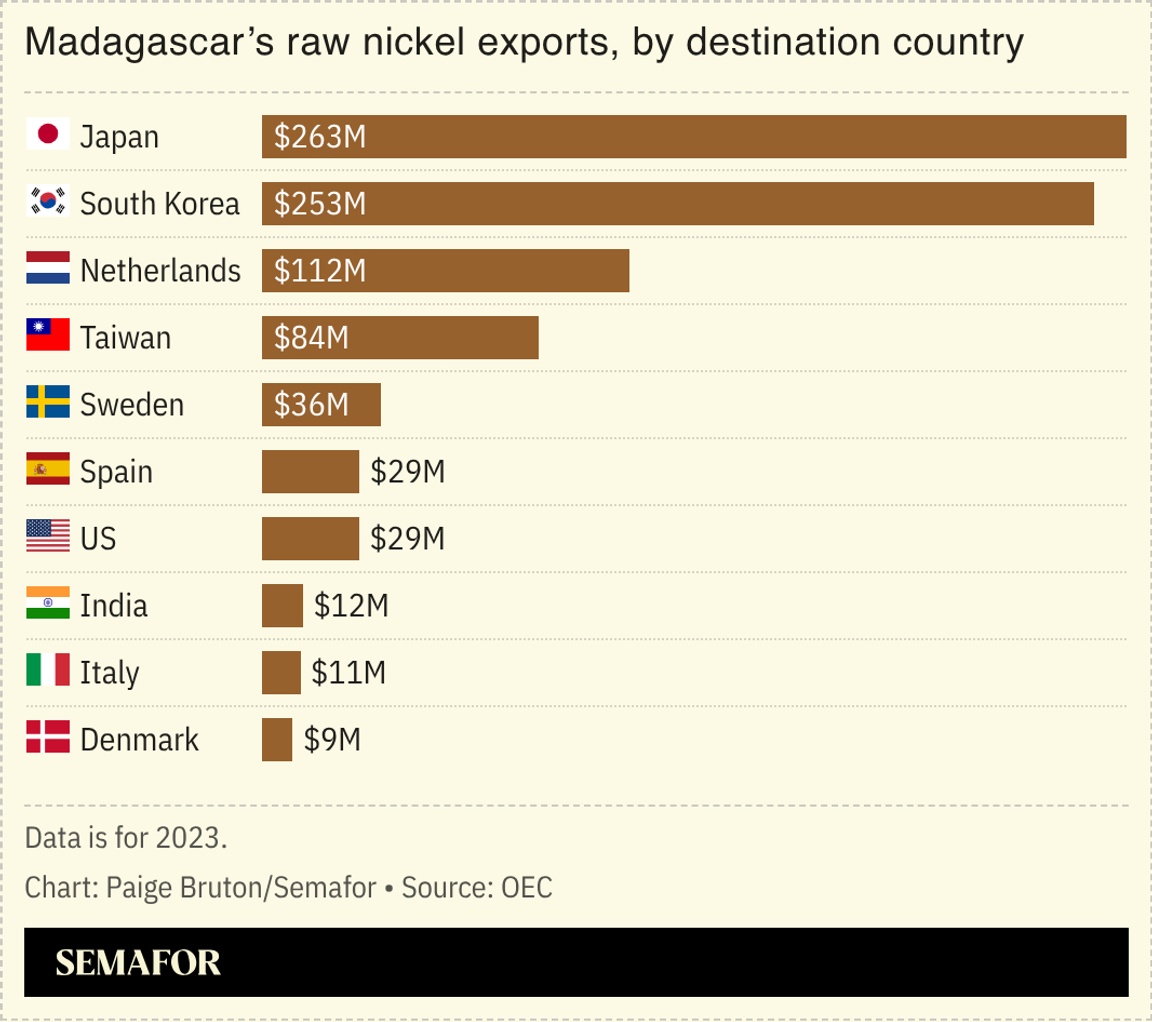

Madagascar ended a 16-year ban on new mining permits while steelmaker ArcelorMittal extended a minerals deal with Liberia, as competition for Africa’s natural resources intensifies. The lifting of the moratorium in Madagascar applies to most minerals other than gold. The world’s second-largest island nation, where the military seized power last year, has long relied on its exports of nickel, cobalt, graphite, and ilmenite, critical minerals used to produce items such as electric-vehicle batteries and aerospace alloys. Around 1,650 mining permit applications were pending as of 2023, Reuters reported. Meanwhile, Luxembourg-headquartered ArcelorMittal negotiated an agreement with Monrovia to retain mining rights until 2050, saying it will pay the government $200 million for the extension and reserved access to railroads. The growing global scramble for critical minerals creates “new economic opportunities” for governments but also adds “political pressure” to renegotiate contracts, increasing regional tensions and security risks, the Bloomsbury Intelligence and Security Institute noted. |

|

Niger leader speaks out on airport attack |

Niger’s junta leader General Abdourahamane Tiani. Mahamadou Hamidou/File Photo/Reuters. Niger’s junta leader General Abdourahamane Tiani. Mahamadou Hamidou/File Photo/Reuters.Niger’s military ruler accused France, Benin, and Côte d’Ivoire of sponsoring an attack on the country’s international airport — without providing any evidence. Suspected jihadists launched the assault early on Thursday and Bloomberg reported that it happened near a major uranium stockpile. Twenty attackers were killed and four military personnel injured, according to Niger’s defense ministry, before normal services resumed at the airport in the morning. Speaking on state television, junta leader Abdourahamane Tiani vowed to retaliate in comments that underscored Niger’s deteriorating relationship with its former French colonizer and those it views as French proxies: “We have heard them bark, they should be ready to hear us roar,” he warned. He also thanked Russian troops stationed at the air base for “defending their sector.” Niger has embraced ties with Moscow since the 2023 coup that brought Tiani to power and ousted democratically elected President Mohamed Bazoum, who remains detained at the presidential palace in Niamey. Niger’s pivot away from France dealt a blow to Paris, which used Niamey’s vast uranium deposits to run its nuclear power plants. |

|

African startups turn to debt financing |

| |  | Alexander Onukwue |

| |

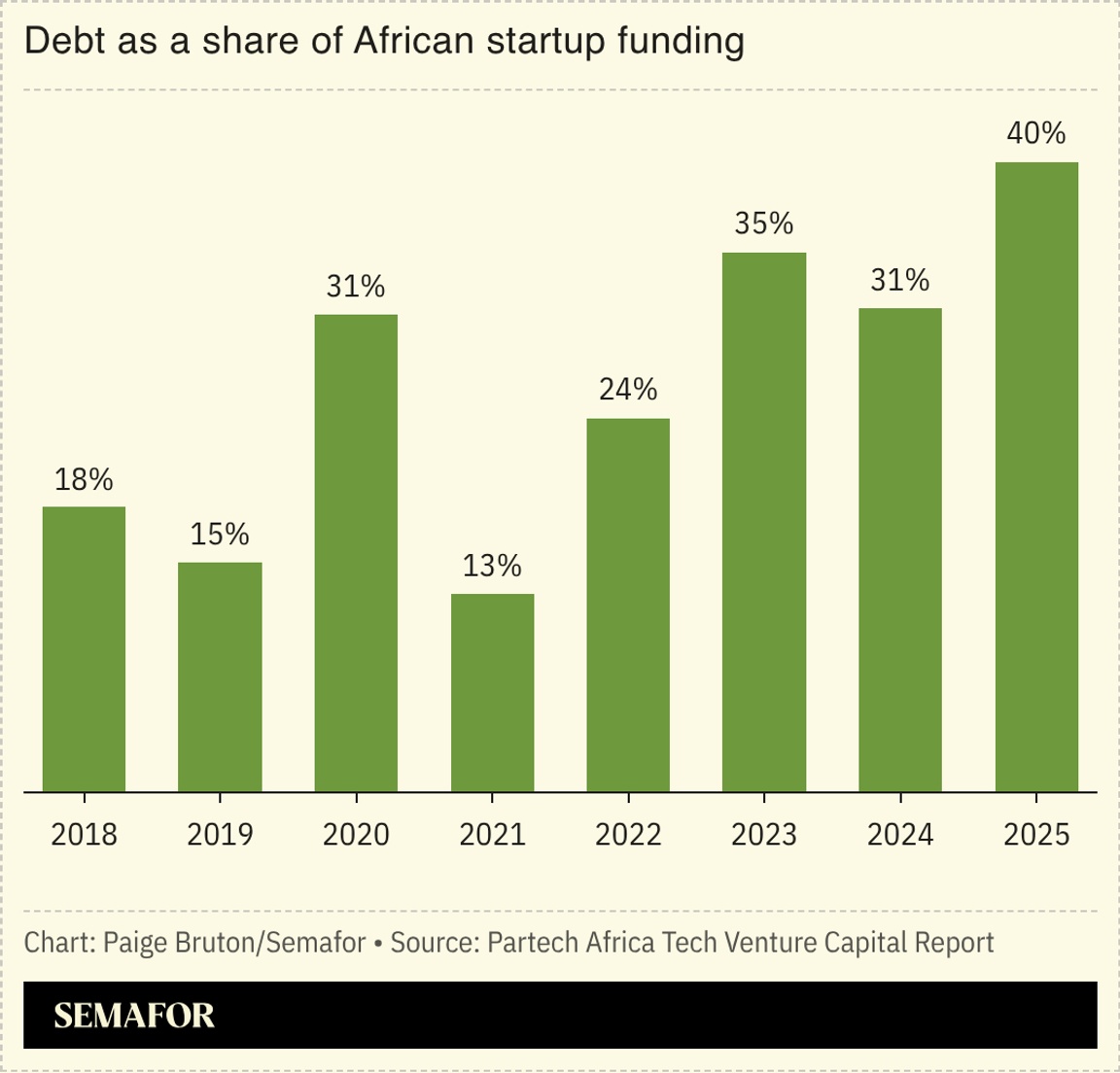

African startups raised a record sum in debt financing in 2025, as investment in the continent’s maturing tech scene rebounded with growing interest from financiers. Startups in Africa raised $1.64 billion through debt last year, exceeding the mark in 2024 by more than 60%, according to a report by Dakar-based venture capital firm Partech Africa. Debt as a share of annual VC investment into African startups reached 40% for the first time since Partech started tracking the data a decade ago. “It is a sign that African startups are getting more mature and predictable,” Tidjane Deme, Partech Africa’s general partner, told Semafor, noting that there is a higher eligibility bar for startups to raise capital through debt compared to equity. |

|

Ghana and Google ink AI deal |

Andrew Aitchison/In Pictures Ltd./Corbis via Getty Images Andrew Aitchison/In Pictures Ltd./Corbis via Getty ImagesGhana is partnering with Google to develop AI-powered education tools in local languages, starting with Twi, Ewe, Dagbani, and Hausa. The program will later be scaled up to cover all 12 approved Ghanaian languages. Of the 7,000 languages used worldwide today, education instruction is limited to 351, leaving many students with huge learning gaps. A shift to bilingual and multilingual education in Africa — which is home to around 2,000 languages — rather than teaching exclusively in the colonial language, usually English or French, has already underscored the benefits of children learning in their mother tongue, the UN said. Ghana’s education minister emphasized the importance of including Hausa — spoken by around 22 million people across West Africa — in the AI initiative. “Language accessibility determines who can benefit from digital transformation,” TechAfrica News founder Akim Benamara wrote in a column last year. |

|

- A case concerning the 1961 assassination of Patrice Lumumba has resurfaced, as Belgian authorities seek to prosecute a former diplomat accused of unlawfully detaining DR Congo’s first prime minister ahead of his murder. Former colonial power Belgium’s moral reckoning over the assassination contrasts with the failure of post-colonial Africa to confront the political vision for which Lumumba was killed, an Al Jazeera columnist argues. Lumumba is remembered as an anti-colonial martyr, writes Tafi Mhaka, but his ideas about “sovereignty, land and the limits of political freedom” unsettle African leaders.

- Traditional authoritarian tactics to suppress dissent in Africa are eroding, political commentator Justice Malala argues in Bloomberg. Recent elections in Uganda, in which President Yoweri Museveni extended his four-decade rule, saw internet shutdowns in the days before polling. But tech-savvy Gen Z protesters around the world have circumvented similar digital blackouts using Starlink, encrypted messaging apps, and platforms like Discord. “The days when repressive digital tactics could keep an unpopular regime in power are clearly numbered,” Malala writes.

- Sudan’s disastrous civil war risks spilling out into the wider Red Sea region, two Africa experts warn in Foreign Policy. The UAE, which is accused of backing the Rapid Support Forces paramilitary group, appears to be opening a new front in the war through Ethiopia, potentially regionalizing the conflict and amplifying tensions with its Gulf rival Saudi Arabia. To prevent a wider war from undermining US Red Sea policy, the Trump administration “now needs to draw its own red lines with the UAE,” the authors argue.

- An Ethiopian-born engineer is driving a quiet push to produce homegrown electric vehicles in Kenya, The World reports. Tadesse Tessema’s startup TAD Motors has delivered the country’s first EV with a price tag of $10,000: “There is no company, even in China, that can make these cars for this price,” Tessema says, adding it is as affordable as imports of internal combustion cars that dominate Kenya’s roads. The effort faces challenges, however, from Kenya’s unreliable electricity grid and lack of charging stations.

- A major NGO operating across Africa hopes to “decolonize” its sponsor-a-child scheme, Kaamil Ahmed reports for The Guardian. This popular donation strategy, whereby wealthy Western donors handpick disadvantaged children in poor countries to support, creates “a very transactional relationship and quite a paternalistic one,” ActionAid UK’s co-leader says, and “reflects a different time.” The organization’s new leadership wants to shift narratives around aid “from sympathy towards solidarity and partnership with global movements,” Ahmed writes.

|

|

Business & Macro

|

|

|