| | In this edition: Nigeria’s oil overhaul, Botswana targets drug manufacturing, and a $29.5 trillion m͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- Nigeria’s oil overhaul

- Botswana plans drug-making

- Steep US deportee costs

- A $29.5T mineral endowment

- A $3B LNG plant

- Weekend Reads

A refurbished modernist Ethiopian building wins a prize. |

|

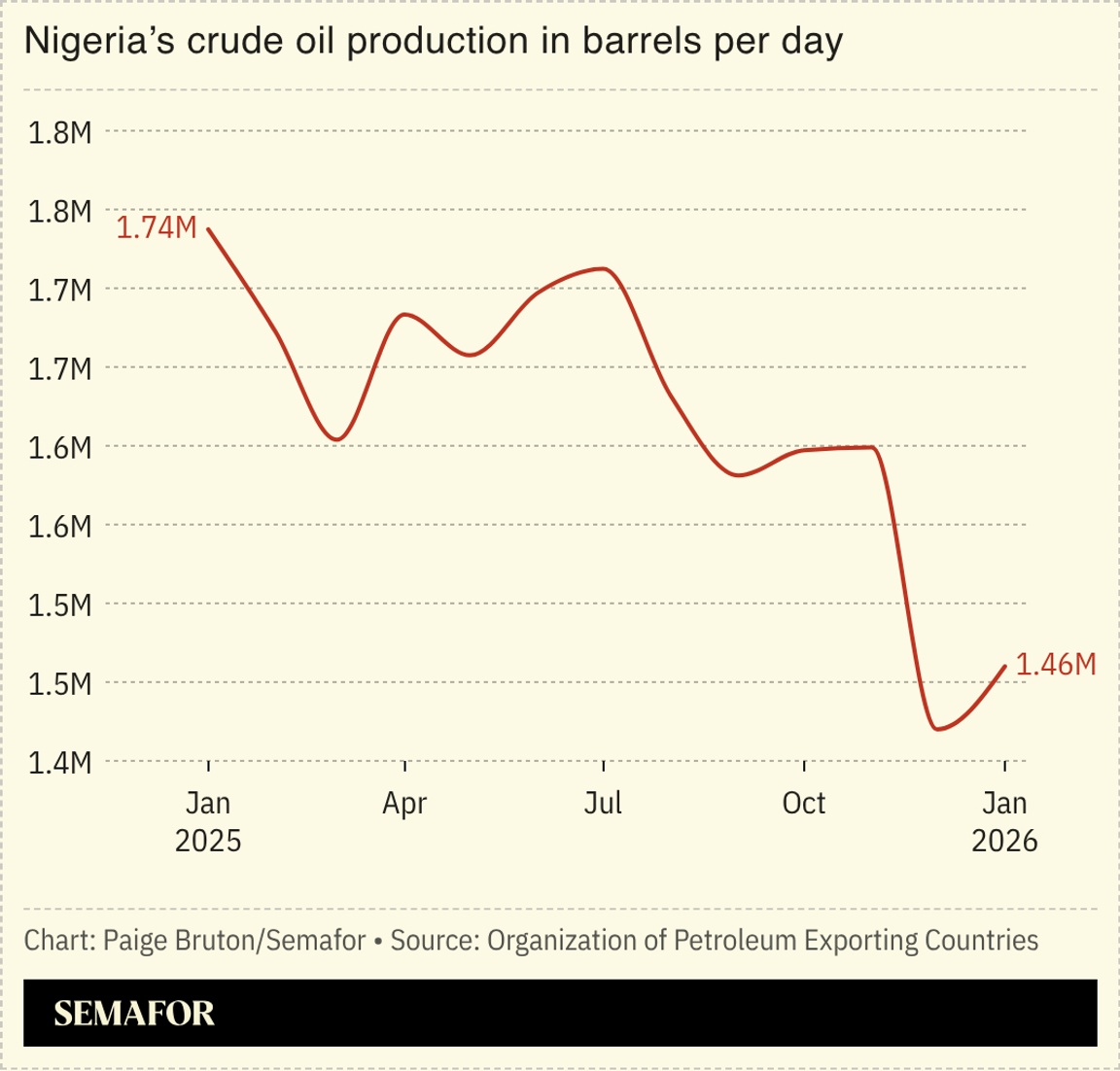

Nigeria grabs more oil revenues |

Nigeria’s government is set to receive a greater share of the revenues generated from oil and gas exploration and production in the country, following a presidential directive to limit fees managed by the national oil company. It is the latest move by Africa’s top crude producer to boost its coffers and comes just a year ahead of presidential elections. President Bola Tinubu’s executive order includes preventing NNPC from collecting a 30% management fee on oil and gas revenues. Tinubu’s office faulted the Petroleum Industry Act, Nigeria’s landmark oil industry law signed in 2021 by his predecessor, for diverting constitutionally mandated funds from the government, and enabling “excessive deductions, overlapping funds, and structural distortions.” The new order will increase money available to state governments for fiscal projects, analysts said, and its proximity to an election year will “limit pushback from some of those who might otherwise have resisted hard,” said Clementine Wallop of Horizon Engage. But, in bypassing parliament, the move stirs questions about regulatory certainty for investors at a time when Nigeria is pushing to ramp up interest in its rebounding oil and gas sector. — Alexander Onukwue |

|

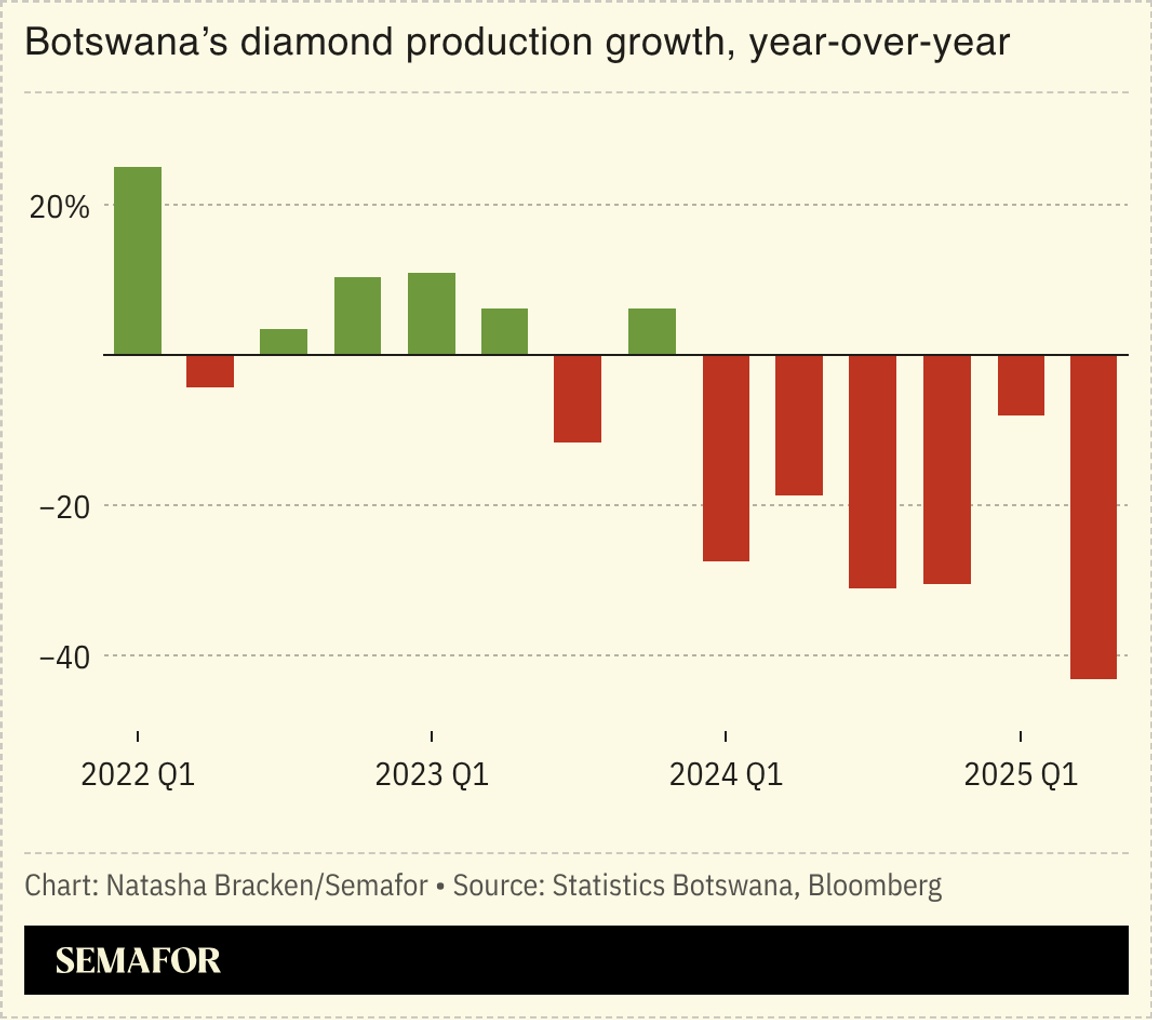

Botswana plans drug production |

| |  | Alexis Akwagyiram |

| |

Botswana is in talks with international pharmaceutical manufacturers to produce generic drugs locally, its health minister told Semafor. The move is part of Gaborone’s bid to recover from a public health emergency triggered by Western aid cuts and a hole in public finances caused by low diamond prices. Botswana, the world’s top diamond producer by value, declared a public health emergency last August due to a shortage of essential medicines and medical equipment. Minister of Health Stephen Modise said the government is in talks with drug manufacturers in India to set up operations in Botswana for a fixed period of time and train locals in an effort to bolster medical supply chains. Gaborone is also devising tax breaks to incentivize local manufacturing and overcome the high cost of importing medication, he said. Botswana, like many other African countries, is heavily reliant on commodity prices: Diamond sales account for about 80% of foreign exchange earnings. The government is trying to increase revenues from its agriculture and tourism sectors and projects the economy will grow by 3.1% in 2026 after two successive years of contraction. |

|

Cost of deporting migrants to Africa |

Undocumented immigrants in the US waiting to be deported. John Moore/Getty Images. Undocumented immigrants in the US waiting to be deported. John Moore/Getty Images.The Trump administration is facing mounting criticism over a costly expansion of deportations that sends migrants to third-party destinations in Africa rather than their home countries — in some cases at a cost of more than $1 million per person. A report by Democrats on the Senate Foreign Relations Committee said Washington has spent more than $40 million on the effort, including at least $32 million in direct payments to governments willing to accept deportees with no prior ties to their countries. Among them: Equatorial Guinea, Eswatini, and Rwanda. Because only small numbers were transferred in some cases, the effective per-person cost, factoring in payments and military flights, climbed above $1 million, with Eswatini cited as a prime example. Africa has become central to the strategy, which is guided by US President Donald Trump’s stated aim to deport “millions of illegal migrants.” Ghana has received West African nationals under similar arrangements, while South Sudan and Uganda have also engaged in third-country transfers from the US. Details of the agreements remain opaque. The administration said the policy addresses cases where countries of origin refuse repatriation. — Yinka Adegoke |

|

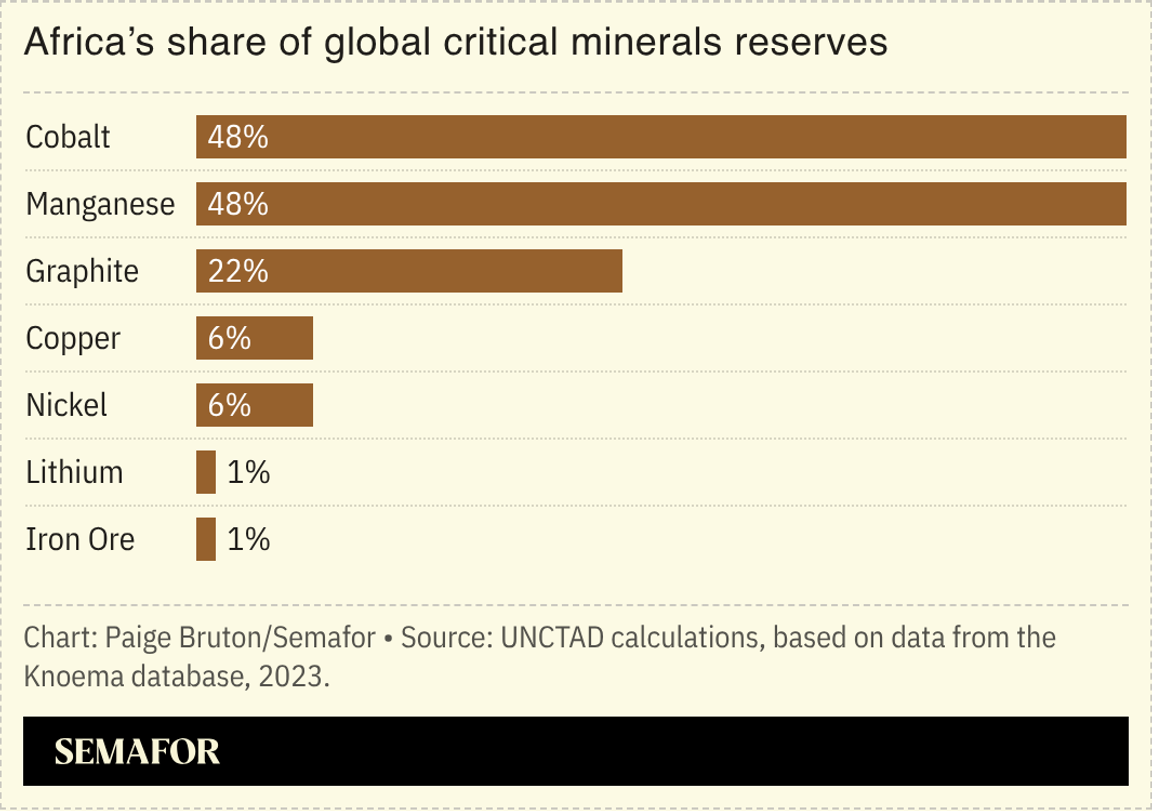

$29.5 trillion mineral endowment |

Africa hosts an estimated $29.5 trillion in mineral value, based on mine-site evaluations, a new report found, accounting for a fifth of global mineral wealth. About $8.6 trillion of these mineral assets remain undeveloped, according to the Africa Finance Corporation. Iron ore, gold, potash, and phosphates are the minerals whose value are the largest contributors to Africa’s undeveloped endowment. Some African countries, such as DR Congo and Zambia, host the world’s largest reserves for some of these minerals, making their development of crucial interest to global markets. AFC cites energy availability as the “single most binding constraint across Africa’s minerals sector” and called for investments in power transmission and distribution infrastructure to support mining development. Efficiently developing mineral sites is necessary for Africa’s own industrialization, infrastructure expansion, food security, and energy systems, AFC argued. — Alexander |

|

Semafor will convene with leaders in Nairobi on Tuesday, March 24 to advance financial inclusion at the intersection of long-term capital, policy, and financial infrastructure. Bringing together investors, policymakers, and financial system leaders, the conversation will move beyond ecosystem-building toward action — mobilizing capital, strengthening infrastructure, and closing persistent access and affordability gaps. Join us as we dive into how coordinated public–private efforts can accelerate inclusive growth across East Africa and other emerging markets. March 24 | Nairobi | Request Invitation |

|

South Africa plans new LNG plant |

The value of a liquefied natural gas plant planned for the port of Durban in South Africa. The global commodity trader Vitol is backing a consortium that wants to build the power station and import facility, Reuters reported. South Africa still generates three-quarters of its energy from coal, but is trying to reduce its dependence on the fuel in a move toward net zero by 2050. With around 40% of the population still lacking reliable access to electricity at home, however, the government still views gas as an important part of the energy mix. “Using Africa’s sizable untapped gas reserves to help electrify the continent is reasonable and fair, despite the need to cut emissions,” a senior fellow at the Atlantic Council’s Africa Center argued recently, saying gas could “provide part of the solution by supporting renewable energy in boosting electrification rates.” Other experts have argued that the country should not pursue another fossil fuel which is not clean energy and instead focus on solar, wind, and green hydrogen. |

|

- Nairobi’s growth as a technology hub can be traced back to a somewhat quotidian revolution in the 2000s: The rise of cheap Chinese mobile phones, Rest of World reports. Undersea broadband connectivity or rudimentary mobile money services that don’t require a smartphone or internet connection “could have done very little for the country’s economy” without a “diffused, capillary infrastructure,” Andrea Pollio writes. An affordable but more sophisticated handset, compared to its Nokia or Motorola precursors, helped make phones ubiquitous throughout the country — and cemented China’s digital footprint, he argues.

- Africa is increasingly grabbing the art world’s attention, but the nascent market must adapt to maintain its momentum, Margaret Carrigan writes for Artnet. Africa is in a “wait-and-see” environment, a South African auctioneer said. Homegrown artists are struggling to get international exposure, and auction sales are declining. The challenge, she writes, is to ensure that the financial and cultural gains from the growing global demand for African art are “not siphoned off elsewhere.”

- As Africa’s population booms, an increasing share of the world’s migrants will come from the continent. While fertility rates in the US and the rest of the Western world fall, educated Africans will be increasingly necessary to sustain domestic welfare institutions. This is the reality behind the far-right’s “Great Replacement Theory,” Guillaume A. W. Attia argues in Liberal Currents, which ultimately fears a pluralistic, liberal, and multiracial vision of democracy. However, as much as the Trump administration has tried to halt this transition, it is an “unstoppable force that will long outlast today’s populists and help define the 21st century,” according to The Economist, which Attia quotes.

- A new study exploring dance scenes and initiation rituals in South African rock art offers new insights into the historical cultural practices of the San Indigenous group. South Africa holds one of the best-documented archives of rock art in southern Africa, and dance scenes are one of the most frequent motifs, Dario Radley writes in Archaeology News. The analysis suggests that dance may be linked to leisure as well as ritual, and that male initiation ceremonies in particular appear to be veiled in secrecy, even from other members of the community.

- A natural forest reserve south of Sudan’s capital, Khartoum, has been completely wiped out as the three-year civil war fuels illegal logging. The 1500-hectare acacia forest had been a haven for migratory birds, and was important in holding back Sudan’s yearly flooding — but now it has been almost entirely reduced to stumps, Abdelmoneim Abu Idris Ali writes for AFP. “During the war, Khartoum state has lost 60 percent of its green cover,” the state’s head of environmental affairs tells the news agency, adding that the wood was mostly used for commercial timber, as insecurity and economic collapse have emboldened loggers.

|

|

Business & Macro |

|

|