| Dear reader: Money Distilled is now behind the Bloomberg paywall. Existing readers will continue to get it for free until December 11th, but after that, it’ll only be available to Bloomberg.com subscribers (and terminal users, of course). So sign up if you haven’t already at the bonus rate outlined in the box above. You get far more than just this newsletter. You get access to the entire Bloomberg website with its unrivalled global coverage of markets across the world, including my colleague Merryn’s brand new newsletter. If you want to be informed, rather than told what to think — a rare commodity these days — sign up now. Bank of England Governor Andrew Bailey may need to book an appointment with his physio. I’m only saying that because he must surely be suffering from a bit of whiplash, what with the sharp change in direction he’s had to take in recent months. It was only at the start of October that he spoke to the Guardian about the Bank possibly being “a bit more aggressive” in cutting interest rates, inspired no doubt by the Federal Reserve’s half-point cut in September. Yet this week, in the wake of Chancellor Rachel Reeves’s budget, it seems that Bailey is very much back in “softly, softly” mode. In his annual report to the Treasury Select Committee, he advocated a “gradual approach to removing monetary policy restraint,” citing among other things, uncertainty about how the hike in employer National Insurance contributions will feed through into the wider economy. After today’s inflation figures, he’s probably grateful he made the U-turn, even if it put his neck out. Consumer prices index (CPI) inflation came in a little bit hotter than expected, with the headline rate rising by 2.3% year-on-year in October, from 1.7% before – economists surveyed by Bloomberg had seen 2.2% as most likely. But what might worry the Bank more is that core inflation (CPI excluding volatile stuff like food and energy), which was expected to fall from 3.2% to 3.1%, and instead it went up to 3.3%. Services inflation (which tends to be “sticky”) edged higher to 5%. None of this spells catastrophe. Everyone knew that inflation was heading higher, and this general directional shift has been in the Bank’s forecasts for ages. The consensus is that 2025 will see inflation spend more time above 2.5% than below it, and it will probably bang its head on 3% for a while. There’s also a decent chance that the December 2024 inflation figure will come in at 3%. For what it’s worth, we’re not alone either. If you look at UK inflation compared to that of countries in the EU, we’re not showing any real sign of being an outlier (and when we were, it was mostly down to differences in energy price capping policies). The Productivity Risk The concern, of course, is that rather than inflation being modestly higher than we’ve grown used to, it will instead keep surprising on the upside and make it significantly harder for the Bank to cut interest rates much further. We’ve already seen the pound fall quite a bit against the US dollar, partly driven by the post-election exuberance. That’s inflationary, all else being equal. And as Bailey says, the employer NICs hit could come in a number of ways. The optimistic view is that, under pressure, businesses will invest in productivity-boosting technology, so that when people lose their jobs to automation, they will have others to go to, because everyone benefits from the growth created by a more efficient economy. Meanwhile, putting more money into the public sector with the tax raised could boost productivity, partly by giving it the resources it needs to function properly, and partly via a quid-pro-quo from the government — extra pay for more efficient practices. The pessimistic view is that firms will rein in expansion plans and won’t raise wages, meaning consumers take a hit and you don’t gain the productivity benefits either. And on the public sector, the risk is that the money just goes into the void, making our public services more costly, but generating no wider benefit. We’ll just need to wait and see – gently does it, as Bailey now believes. But net-net, it’s all yet more evidence, as if we still needed it, that a big drop in the Bank of England rate is not on the cards. Markets now don’t expect another cut until 2025. In terms of what this means for your money – if you’re a saver, make sure any cash savings are in an account that’s offering a real interest rate. These are easy to find now and if your money is still languishing at a rate that is below inflation, you need to move it. Also make sure, where you can, that any cash savings are saved tax-efficiently. In the 0% interest-rate days, you didn’t need to worry about getting taxed on interest, but these days, the government is raising a tidy sum from this source. So get it in an ISA if possible. As far as mortgage rates go, we covered this earlier this week, so I’d just reiterate what I’ve said before – you can usually lock in a rate six months before you need the loan, and as the day approaches, you can shop around if things have improved. The golden rule is to never leave your finances at the mercy of interest rates going in a specific direction, because you cannot guarantee that your hunch is correct. After all, no one (as I may have said before) has a crystal ball. Send any feedback, opinions or questions to jstepek2@bloomberg.net and I’ll print the best. If you were forwarded this email by a friend or colleague, subscribe here to get your own copy. - Make sure you don’t miss our chat about pension drawdown — for all that people pretend pensions are boring, we never get more letters to the editor than when we talk about them. Listen to the latest episode of Merryn Talks Your Money here.

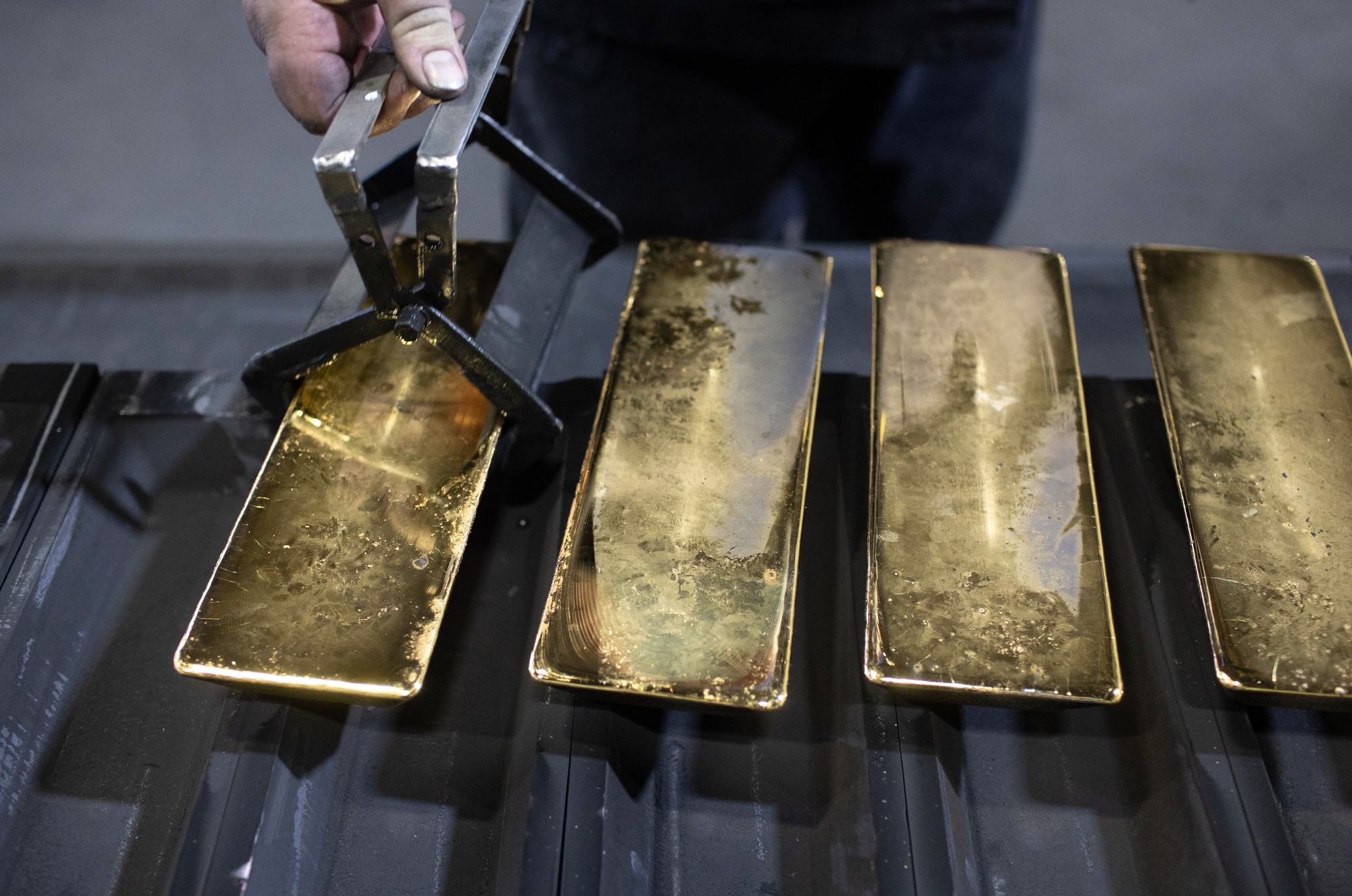

Gold. Photographer: Andrey Rudakov/Bloomberg Looking at wider markets — the FTSE 100 is pretty much flat at around 8,095. The FTSE 250 is down 0.4% at 20,350. Gold is down 0.1% at $2,630 an ounce, and oil (as measured by Brent crude) is up about 0.5% to $73.75 a barrel. Bitcoin is up 1.4% at $93,500 or so per coin, while Ethereum is down 0.1% at $3,090. The pound is down 0.1% against the US dollar at $1.267, and is down 0.2% against the euro at €1.199. Follow UK Markets Today for up-to-the-minute news and analysis that move markets. |